Shiller's PE (Nobel Prize In Economics)

27 July 2021

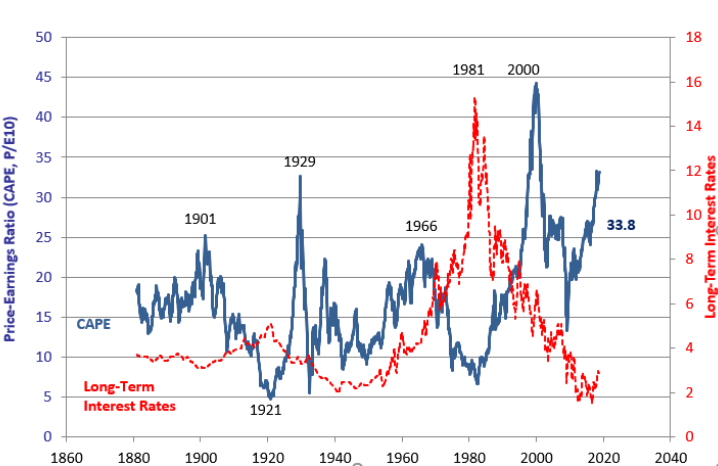

One of the most frequently used metrics to determine the overall level of valuation of financial markets is Robert Shiller's PE.

Shiller in a few words: leading 20th century economist, professor at Yale University and winner of the Nobel Prize in Economics in 2013.

The logic behind the ratio he developed is relatively simple: it compares the market valuation of companies to their net income. Market capitalization is divided by the average net income over 10 years (which smoothes out the effects of cycles).

Over the long term, this ratio oscillates between 5 (postère World War II) and 45 (top of the bubble of 2000). Today, we are at 33.8 : a level highly above the one preceeding the 2008 crisis (around 27) and close to the one of 1929 - where american markets suffered a drop of -88% in 2 years. These numbers speak for themselves.

If we turn to the bond markets, the situation is not better. The risk premium offered by so-called "risky" bonds is returning to its lowest levels, which were reached twice: in 2007 before the onset of the financial crisis and in 2020 just before the outbreak of the pandemic. As a result, investors only earn an additional 2% for lending to a company that is characterized as high credit risk. This is a bet we will not take.

In this type of configuration, a purchase will offer at best a low return, at worst a capital loss. As our primary objective is to protect our assets, we are choosing prudence and are waiting.

Have a great week,

Pierre and Maximilien

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu