We Look Closer, Case Study With Capgemini

01 July 2021

Capgemini, excerpts from April 29, 2021 Q1 revenue press release:

« The Capgemini Group reported Q1 2021 revenues of €4,271 million, up 24.2% at constant exchange rates compared to the same quarter in 2020.

Aiman Ezzat, Group CEO of Capgemini : "We are achieving a very good first quarter 2021 and returning to organic growth." ''

I didn't quite understand the "return to organic growth" when they announced +24%.

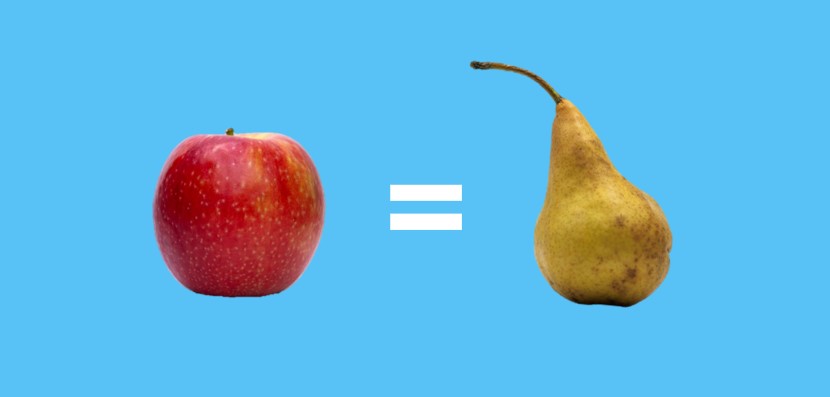

Then I found the answer: Capgemini bought Altran, which is integrated in the accounts from April 1, 2020. So this "+24%" is an apples to pears comparison (the 2020 figures are without Altran and the 2021 figures with Altran!). If we don't take into account the acquisition, Capgemini's growth is ... +1.7% in Q1 2021.

So I ask you: is it normal that the share, which was worth €109 on December 31, 2019, is worth €164 (+50%) today?

Have a great week,

Charles

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu