A little trip to the Bellagio?

19 April 2022

A white Rolls cruises slowly, in a biblical silence - disturbed only by the sound of the engine and the squealing of the tires on the asphalt. It's hot, August and the sun is blazing in the Nevada desert.

At the intersection of Flamingo Road and Harmon Avenue, the left turn signal is activated, and the vehicle slowly turns onto the ramp of one of the most fashionable establishments in Las Vegas, the Bellagio.

The driver gets out and opens the right rear door, from which gets out the protagonist of our story: Mr. Lee.

Mr. Lee is one of the hottest poker players in the game today. He has won the World Poker Series four times and is coming to defend his title. To do this he has brought with him 1 million dollars - in cash, can you imagine ? - ready to be used on the green carpet.

After settling into his seat, which he will not leave for the next 48 hours, he orders his favorite drink: an Americano.

The first few hands go well, but soon enough his luck runs out: within a few hours, his million dollars is well underway, and the prospects of winning are rather slim. With a discreet wave of his hand, Mr. Lee calls out to the casino manager.

To get back on track, he will use an age-old principle: leverage. The theory is simple: Mr. Lee asks the bank for a $10 million advance (against reimbursement with interest, of course - the Bellagio is not an NGO either), which will allow him to play with 10 times his initial stake and thus multiply his potential profits by that much (... his losses too...).

At the beginning, the results are amazing: the luck is there, and the profits are very substantial (he now has 13 million dollars in front of his eyes!). However, after a few unfortunate card tricks, his chip stack drops from $13 million to 5. And that's a real problem because remember, he owes the casino 10.

At this point, two rather grumpy looking men ask him to follow them to a separate room: it's time to check out. And Mr. Lee doesn't really have a choice: he has to find the money no matter what. To do so, he sells his personal assets, which he really cares about, and what a shame to see this magnificent Rolls Phantom sold off for a fraction of its purchase price... It's bankruptcy.

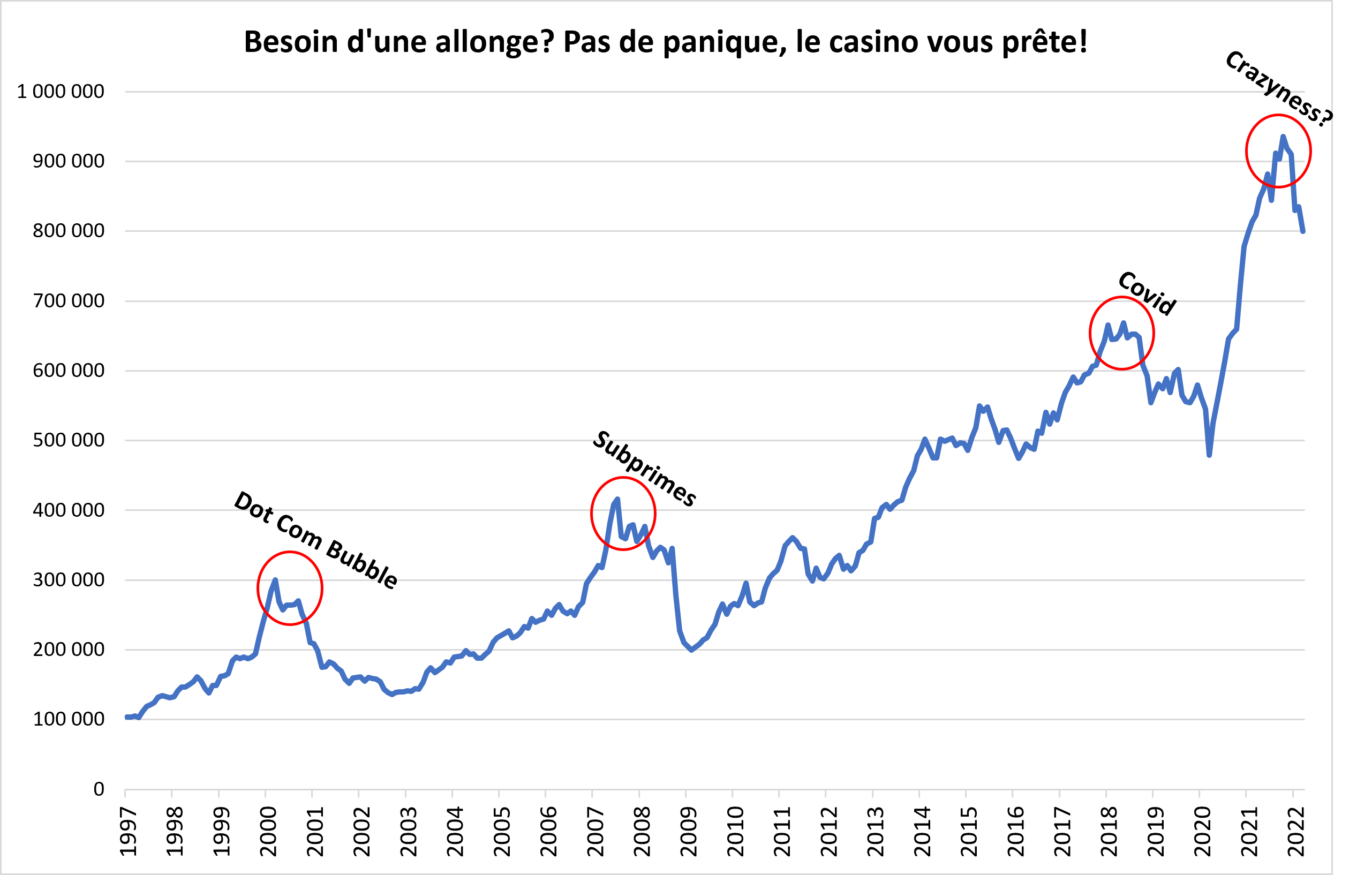

Today, financial markets are the Bellagio, investors are Mr. Lee and stocks are Rolls Phantom. After the recent crises we have experienced, leverage has fueled the unprecedented rise of the last few years but is now at an all-time high, it is starting to decline and in general this is not a very good omen (here is a rather eloquent graph).

Sin City you’ll say to me....

Have a great week,

Max

Source: FINRA - balance in margin call accounts (in $ million)

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu