Bond Kings on the return

11 October 2022

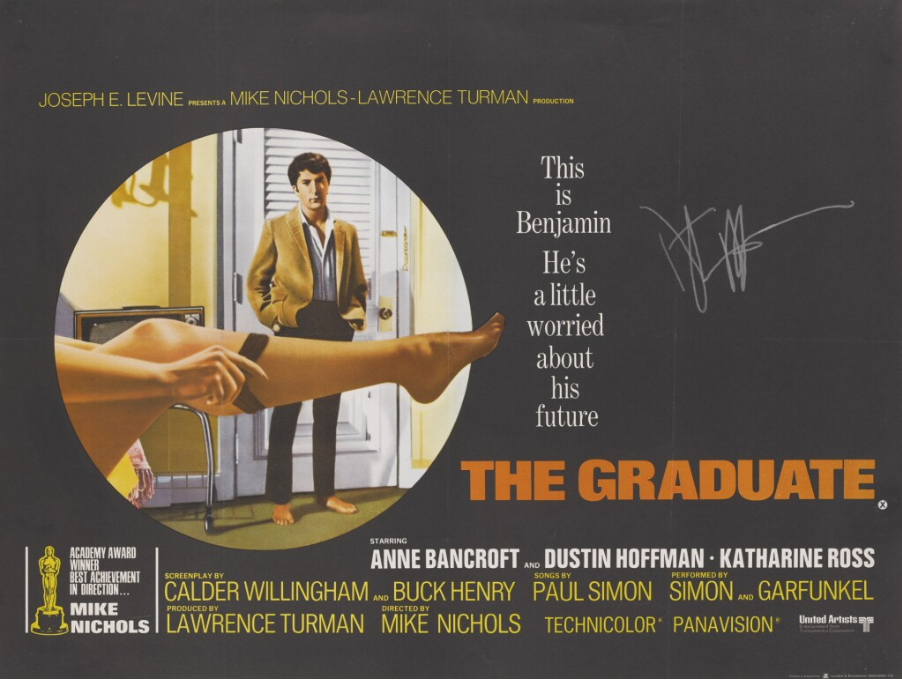

« Don’t you find me attractive? » (Le Lauréat, 1967).

These are the words spoken by Ms Robinson (Anne Bancroft) to Benjamin Braddock (Dustin Hoffman) when she tries to seduce him when he is invited to her home for a simple courtesy call.

This is also what comes to mind at Monocle when we observe that the yield on a 10-year US government bond (surely the safest financial asset in existence) is now 4%. Four times higher than a year and a half ago.

So could bonds be "attractive" again? That's the million-dollar question. And the answer is not obvious.

For a decade and until March of this year, the markets were convinced that interest rates were well positioned at sea level. All was well in the best of all possible worlds: any company could take on debt almost for free and financiers seemed to have forgotten the notion of 'risk'. There was no point in dwelling too much on the asset class in our view.

Then, little by little, after a rude awakening on the subject of inflation, a 180 degree turn: the FED raised its key rates from 0.25% to 3.25% in less than 6 months, the ECB raised its rates from 0.0% to 1.25% in less than two months and the system is really starting to feel the consequences (the economic situation in the UK is typically one to watch closely). At the same time, bond prices are falling (the Bloomberg US Agg Bond Index is down 14% year-to-date) and bond yields are rising.

An opportunity seems to be emerging and this view is shared by those I call the Bond Kings. Among them:

- Bill Gross, 78, founder of PIMCO (the largest player in active interest rate management with USD 1.8 trillion in assets), mentioned not more than a week ago that the Fed had little room to raise rates much higher, otherwise the system would not hold. He is currently positioning his funds in medium and long maturity bonds.

- Howard Marks, 76, founder of Oaktree (USD 160 billion in assets), stated in June in an article of the Financial Times That he was redeploying more aggressively on corporate bonds because : "Everything we deal in is significantly cheaper than it was six or 12 months ago, (…) I think the idea of waiting for the bottom is a terrible idea"

At Monocle, we intend to take advantage of this situation to put some of our cash to work in securities that - at long last - actually have attractive yields. We do this with two fundamental principles in mind:

1) it is essential to be very careful about which bonds to invest in, the economic situation is deteriorating and the level of defaults is expected to rise. This was said by Jamie Dimon (head of JP Morgan Chase - which will publish its results at the end of the week) just yesterday.

2) It must be done sparingly because the system as a whole is now in a state of fragility rarely seen in the last fifty years. This is the point of view Of Raghuram Rajan (former Governor of the Bank of India and main herald of the subprime crisis in 2005).

Market and portfolio focus

Behaviour:

Over the past week (from 30/9 to 7/10), the fund gave up -0.5% of performance while the Nasdaq 100 recovered +0.6%. Nothing special to mention except that volatility seems to be back - as evidenced by the fact that the US indices broke their lows of the year yesterday. The results start this week and caution is still the order of the day.

Lines: (September Factsheet) :

– Levi’s 2027 :(1% of the fund), The line is under construction given its 6% yield in EUR on a company with a strong balance sheet and an extremely strong brand. A great bond opportunity in our view.

– Pfizer :(8% du fonds)We have added 2% to our position following the decline in the stock over the past few weeks. The valuation still seems very low compared to the operating results and the recent dynamics of Covid should contribute positively to the latter by the end of the year.

Have a great week,

Max

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu