Sugar

11 January 2023

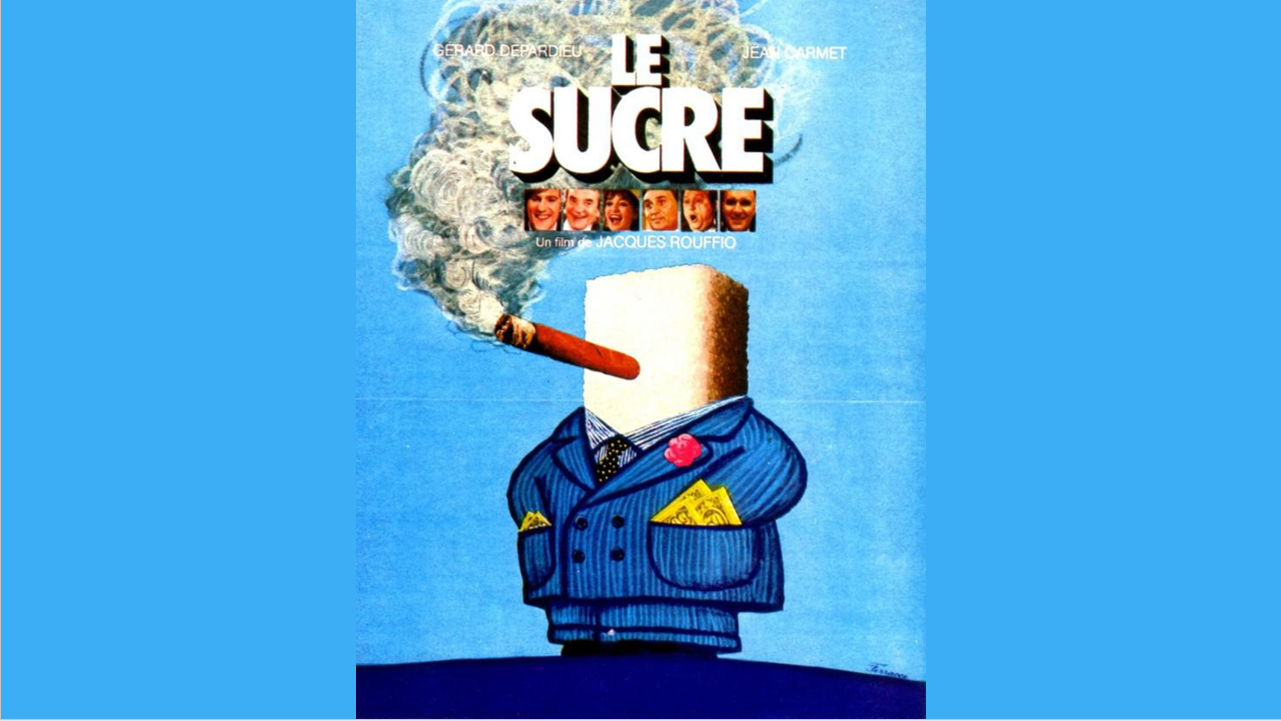

« Mais tu en connais encore des acheteurs aujourd’hui, des encore plus cons que toi? » ("Do you still know any buyers today, ones even dumber than you?") (Gérard Depardieu, Le Sucre, 1978) Sugar, 1978)

These words resonate as Viscount Raoul-Renaud d'Homécourt, a cunning broker portrayed by Gérard Depardieu, confronts Adrien Courtois, played by Jean Carmet, upon learning of his staggering 600-ton sugar position during the infamous stock market frenzy of 1974. This dialogue stands as one of the most cynical in films depicting speculation.

As a side note, between 1974 and 1975, sugar prices listed on the Paris stock exchange skyrocketed eightfold, only to plummet by a factor of five due to an unprecedented fervor among speculators (which would inspire Jacques Rouffio to make a film about it).

What is truly remarkable, however, is that the market landscape from 1974 to 2023 has witnessed scant evolution: it is still filled with absurdities.

For instance, did you know that between 2019 and 2023, the price of eggs—yes, you read that correctly—has tripled (see image below)? Moreover, gas prices experienced a tumultuous journey, first multiplying and then abruptly plummeting by a factor of six within a single year. A similar observation can be made about stocks: in the period from 2020 to 2023 alone, a fund like Cathie Wood's (Ark Invest) saw its valuation triple before being divided by five. It is evident: VOLATILITY reigns supreme

The source of this volatility lies in the unrestrained flow of free money from central banks, which has fundamentally severed asset valuations from any semblance of intrinsic worth, and their lack of credibility in combating inflation does not help the spasmodic episodes of financial markets (2022 was a good example, and 2023 seems to be starting under the same omens).

Sur ces sujets, l’excellent article On these matters, the excellent article by Raghuram Rajan (former president of the Bank of India) in the Financial Times sheds light: central banks have a real credibility problem, and they will have to address it (which the market seems very reluctant to accept) if we want to overcome the dilemma we find ourselves in regarding rising prices. The resilience of the job markets in both Europe (6.5% unemployment, a thirty-year low) and the US (3.5% unemployment, a record) still poses a significant problem regarding what our central bankers desire: a decrease in consumption. Larry Summers, a seasoned authority on the subject, vehemently articulates this concern . le mentionne avec vigueur.

Nevertheless, our philosophy is not to make big bets on these discussions, but the state of the world as it is today pleases us much more when viewed through the prism of financial markets (which diverge greatly in how they treat companies and asset classes). Managers who take positions will finally be able to regain their strength compared to index management and create real added value for their investors.

We are steadfastly committed to boarding that train.

Market and portfolio focus

Behaviour:

Since the beginning of January, the fund has delivered a performance of +1.57% (as of 6/1). This compares to relatively stable equity markets in the United States (+0.9% for the Nasdaq and +1.4% for the S&P 500) and bullish trends in Europe (+6% for the Euro Stoxx).

Lines:

Apple (4% du fonds) : nous avons investi 4% du portefeuille sur Apple, elle se paye aujourd’hui 19x (ce qui n’est plus si élevé) avec une division services en nette croissance – W. Buffett détient plus de 5% du capital.

Atos 2025 – Ceconomy 2026 (de 1% chacune à liquidation des positions) : cession de ces deux positions obligataires – le contexte économique actuel nous incite à la prudence sur le crédit en situation tendue.

Couverture Nasdaq (de 10% à 5% du fonds) Nasdaq hedge (from 10% to 5% of the fund): We have reduced a portion of our hedging position to reposition the fund's exposure to equity holdings.

Have a great week,

Maximilien

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu