The most valuable company of Germany

01 March 2023

Exactly 7 years ago, on February 27, 2015, the Financial Times ran the headline: "Volkswagen Warns of No Margin Improvement This Year." Despite this "calm down" from management, Volkswagen's share price reached an all-time high of €225.

Shortly thereafter, the share price began a gradual decline, which turned into a steep descent six months later with the eruption of the Dieselgate scandal, ultimately causing it to plummet below €100. At that moment, the Financial Times published articles titled "Seven Reasons Why Volkswagen is Worse than Enron" - note for young readers of the post: Enron: a reference to the infamous fraud of the early 2000s that led to bankruptcy.

Faced with this apocalyptic scenario, Volkswagen rolled up its sleeves. It left the Dieselgate debacle in the rearview mirror, appointed a new CEO from outside the group (Herbert Diess from BMW), and simultaneously decided to take enemy number 1 head-on: Tesla.

Fast forward six years to March 2021, and the Financial Times was once again able to proclaim, "Volkswagen is Once Again the Most Valuable Company in Germany." The article delved into the excitement generated by the company's electric ambitions, including plans to establish new factories from scratch.

However, history repeated itself as the company experienced another downturn. Diess's visionary goals were met with lackluster execution. Sales volume continued to decline, causing the share price to plummet by half, settling at €120. Consequently, the triumvirate responsible for decision-making at Volkswagen (comprised of the Porsche family, who holds 50% of voting rights, the state of Lower Saxony with 20% of voting rights - a politically charged matter given Volkswagen's substantial workforce of three hundred thousand employees in Germany - and the indispensable employee union) decided to remove Diess from his position. Oliver Blume, the former CEO of Porsche, stepped in as his successor.

Can Blume turn the tide? The outcome remains uncertain. He recently made significant amendments to his predecessor's all-electric vision. In a recent announcement made by the group's CFO, the following statement was issued:

"We will not establish any new electric factories in Europe; instead, we will focus on transforming the existing ones."

To put it into perspective, imagine yourself as a carriage manufacturer in 1923. Your discerning boss realizes that the era of horse-drawn carriages has come to an end, and to compete with Ford, a grand-scale factory with assembly lines and Taylorism principles is essential. However, with a change in leadership, the new executive declares, "No, we won't build a large factory. Instead, we will transform our workshops designed for carriage production into workshops for manufacturing automobiles." Such a departure from the original plan may not garner the desired success.

For those who have had the diligence to read this far, you may be inquisitive, "But Charles, what is your rationale for allocating 6% of your portfolio to Volkswagen?!" I am seizing an opportunity where I have identified a substantial margin of safety in a market that offers scant options with such attributes. The essence of Volkswagen's security lies in its price: notwithstanding the aforementioned risks, Volkswagen remains a big cash machine.

We have the initial public offering of Porsche and the consequential bestowal of a special dividend: a net €16 per share. In contrast to our investment of €7 million in October at a share price of €127, this dividend has already yielded a recuperation of €1 million.

Additionally, we must consider the ordinary dividend. In 2015, it amounted to €4.80 per share. Presently, it stands at €7.56, denoting a yield of 6%. Given our entry price of €127, this translates to an equivalent yield of 6%. Over the past two decades, this yield has reached its zenith, surpassing the average of 3%. Consequently, to restore its equitable average valuation, the share price would need to double. Naturally, the cogency of this argument hinges upon the sustainability of this dividend. Last year, the dividend outlay amounted to a mere €3 billion, which pales in comparison to the company's operational earnings of €20 billion, quelling any apprehensions.

In summary, we are presented with a compelling dossier: intricate, necessitating multifaceted analysis, and encompassing an array of plausible scenarios. However, the overarching allure lies in the substantial margin of safety, fostering tranquility. Hopefully, the Financial Times will soon run the headline "Volkswagen is once again the most valuable company in Germany".

Have a good week,

Charles

Post scriptum: : Whilst delving into this investment case, I unearthed two intriguing figures worthy of mention:

China/India: The populous nations of China and India boast equivalent populations of 1.4 billion people. Nevertheless, in 2022, China witnessed the sale of 23 million automobiles, while India lagged behind with a mere 4 million units sold.

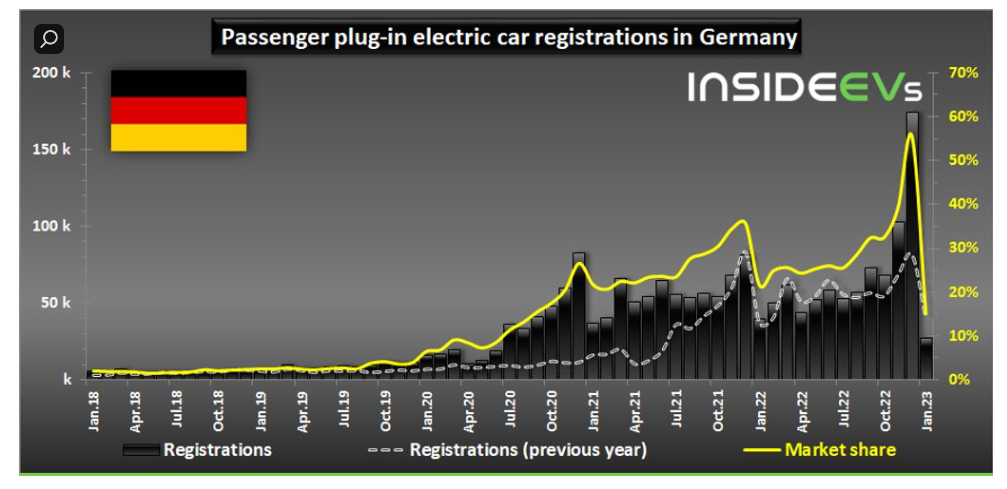

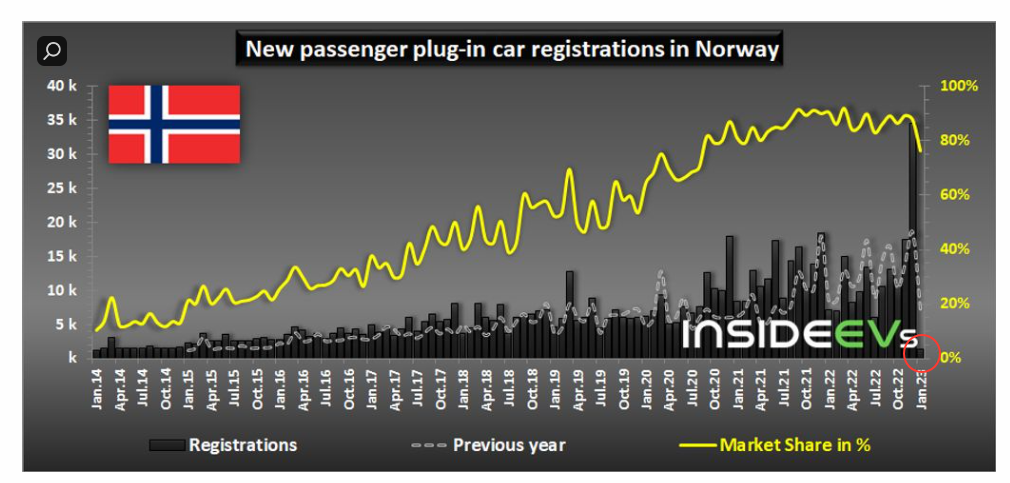

The "end of tax exemption" effect: Many countries are beginning to reduce tax incentives for electric vehicles. The measure applies from a cut-off date onwards, resulting in an explosion of orders just before the date, and an abrupt halt just afterwards. Here's a pictorial example of Germany and Norway, which had such measures in force from January 1, 2023.

In Norway, the little red circle at the bottom right represents sales in January. Obviously, for those who had made a linear interpolation with the figures for 2022 and therefore forecasts that were through the roof, the wake-up call is brutal.

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu