Good news about Volkswagen

08 March 2023

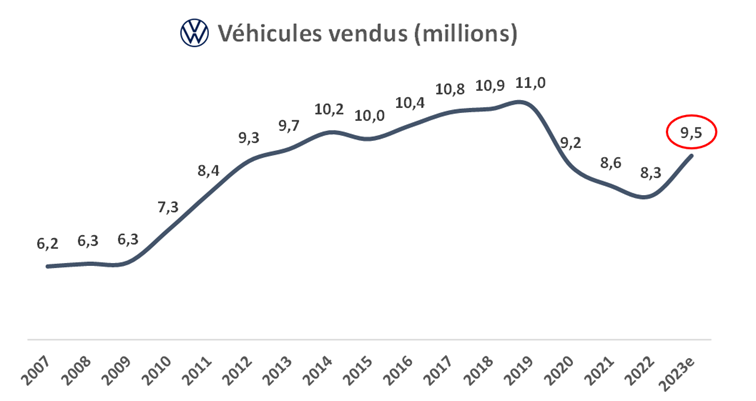

Last Friday, the Chief Financial Officer of the Volkswagen Group (holding a 6.7% stake) shared the group's expectations for the year 2023. Vehicle sales are projected to increase by 15% to reach 9.5 million units.

Our investment thesis includes the statement: "a significant upside in sales and margins in the event of an adjustment in the volumes of vehicles sold."

Let us explain why

Over the past three years, the volumes of vehicles sold by the VW group have experienced a sharp decline. The pandemic, supply chain disruptions, and the Russo-Ukrainian conflict have greatly impacted the production and delivery capabilities of automotive manufacturers.

However, the group's revenue has continued to grow, reaching €280 billion in 2022 compared to €250 billion in 2019, despite a 25% decrease in volumes.

This can be attributed to the price. Over the past three years, the average price of vehicles sold by the group has increased from €20,000 to €28,000. This increase has more than compensated for the decline in volumes.

But these volumes were not meant to decline indefinitely. The lingering effects of the pandemic are dissipating, particularly in China. The situation in the supply chain is improving, and the manufacturers have taken measures to reduce their dependence on production zones in Ukraine. Consequently, Volkswagen expects a return to selling 9.5 million vehicles this year.

The impact on sales is significant: projected revenue of €315 billion. Moreover, the profit margins are increasing (easier absorption of fixed costs), with an expected operating profit of 8%. The analyst consensus had previously settled at 7.1%.

This has given the management enough confidence to raise the dividend to €8.70 per share, up from €7.50 previously.

The share price rose by 11% on that day.

This is indeed good news.

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu