Rivian the next Tesla ?

23 March 2023

A few years ago, when Tesla was a controversial stock, we invested in its bonds. From a financial perspective, it wasn't clear whether Tesla would succeed. However, I came across some interesting information about the quality of Tesla cars from an American automotive engineer named Sandy Munro. After starting his career at Ford in the late 70s, he founded a consulting company to delve inside cars, particularly electric ones. His first report was on the BMW i3 in 2015, and it spanned 24,000 pages. He meticulously dismantled the car, piece by piece, like a mechanic. I remember hearing him say, "Those who think Musk is lying about the level of margin haven't looked inside this car," when we had the Tesla bonds.

In short, Sandy Munro knows a thing or two about cars. And today, he is driving a Rivian.

Rivian the next Tesla ?

Rivian, the American company specializing in electric vehicles, made its debut in the stock market in November 2021, raising an impressive $12 billion - excellent timing. Two weeks ago, the company raised $1.5 billion on Monday, March 6, 2023, through convertible bonds to finance the development and launch of its "R2" vehicle series. The R2 is a smaller and more affordable version of its current offerings, the R1S (SUV) and R1T (pickup truck). The R2 is intended for the European market, where vehicles are generally smaller and more compact.

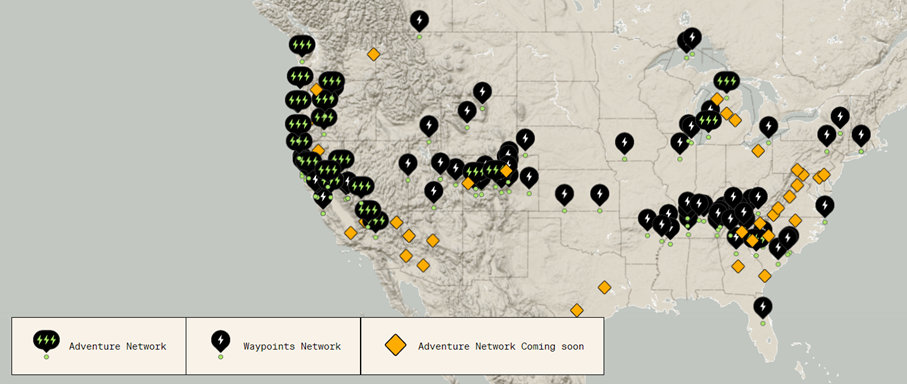

Rivian has its own network of charging points across the United States, which it continues to expand, and it will later benefit, like other automakers, from Tesla's charging points in the US. Tesla is required to open a portion of its chargers to non-Tesla vehicles in order to qualify for the planned US government subsidies.

CEO & Produit

CEO RJ Scaringe seems to know what he's doing when it comes to product development. A car enthusiast himself, he has successfully convinced major players like Ford and Amazon to invest in Rivian. Amazon has also placed an order for 100,000 electric vans, diversifying Rivian's business.

Rivian develops and manufactures its own vehicles, software systems, and autonomous driving experience, giving the company full control over its production portfolio. The R1T (light truck) has received acclaim from experts, including Sandy Munro. In 2022, the company delivered 20,000 of these trucks, indicating mass production capability. Light trucks are the flagship vehicle category in the US, accounting for 70% of sales. Rivian currently ranks 15th, with the Ford F-series (gasoline) series securing the top spot with 650,000 deliveries for the 46th consecutive year. The electric Ford F-series, known as the Ford Lightning, sold 15,000 units. Therefore, Rivian is performing well, and the market potential is significant.

With Rivian, we are now at the level of Tesla's deliveries (the gold standard of the EV market) in 2013. However, Rivian can progress faster because it has significantly more available funds now that the markets trust the sector. Its R&D spending is four times that of Tesla at the same stage.

All of this is quite exciting. After the initial exuberance, the stock price has returned to more normal levels, experiencing a 90% decline. So now's the time to get in on the action. However, it is important to note that success is not guaranteed. All automakers are starting to release EV models, including in the pickup truck sector. Additionally, Tesla will eventually launch its Cybertruck.

In this challenging context, there is an interesting instrument to consider when investing in Rivian: convertible bonds. As mentioned earlier, Rivian has just issued $1.5 billion in convertible bonds with a maturity date in 2029. They currently offer a yield of 5.5% and can be converted into shares above $20. This $20 price corresponds to a market capitalization of approximately $20 billion. If Scaringe succeeds in his venture, Rivian could be worth significantly more. If it proves to be more difficult than anticipated, the cash pile and the partnership with Amazon should provide some protection. We are currently investing 2% of the fund in this bond.

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu