When no one wants it anymore...

19 April 2023

Three factors:

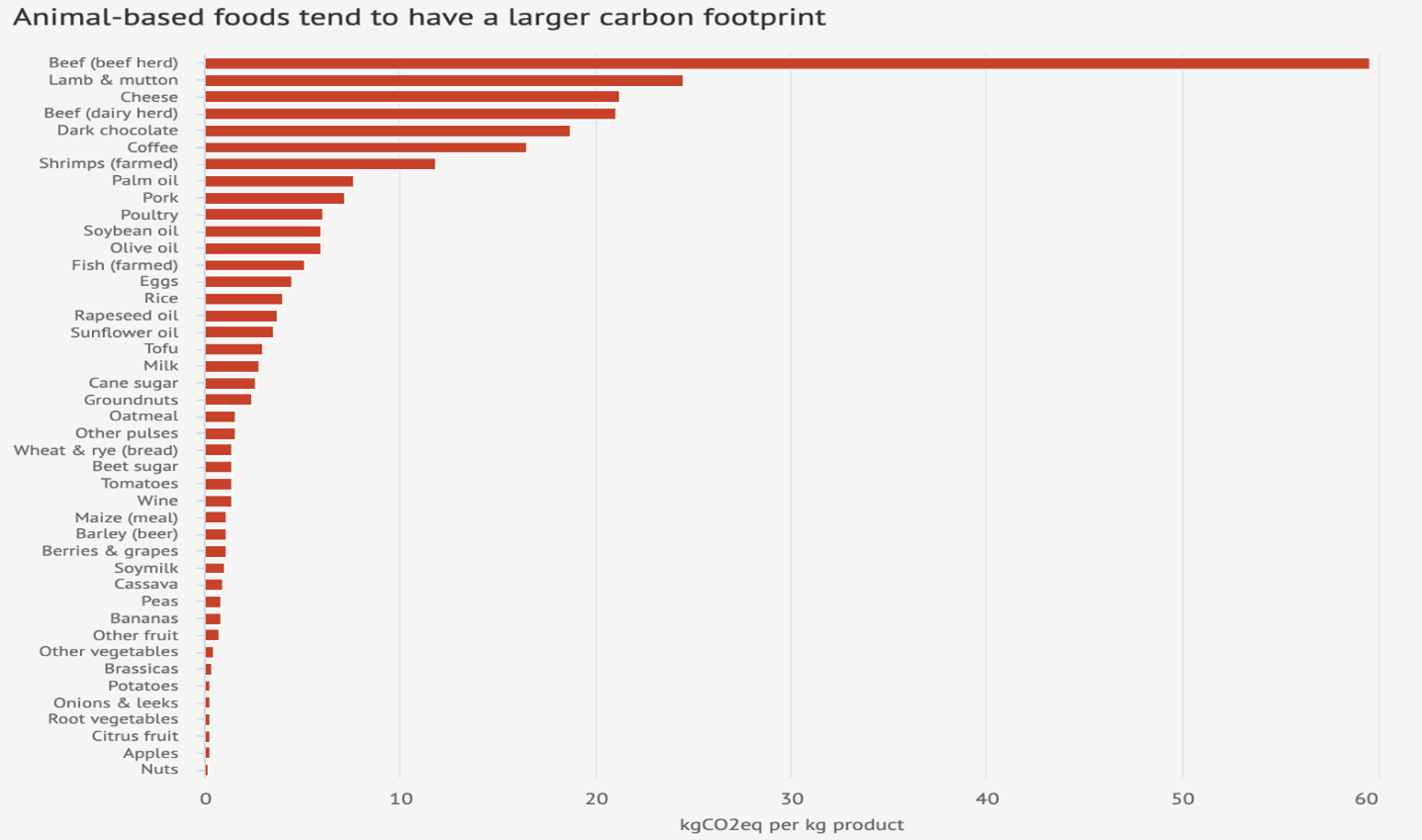

1/ Climate: Globally, approximately 50 billion tons of greenhouse gases are emitted each year. Out of this total, livestock accounts for 7 billion tons, which is 14% of the world's CO2 emissions. This is equivalent to the emissions from the entire transportation sector. (Source: Food and Agriculture Organization of the United Nations) Source: Science magazine, 2018

And the main culprit is beef, as shown in the graph above, published in Science in 2018. As explained by Professor Sir Charles Godfray from Oxford University, "In general, products derived from ruminant animals – sheep, cows, and other four-stomached animals – tend to have a greater impact on greenhouse gases. This is partly due to the fact that ruminant digestion produces a lot of methane."

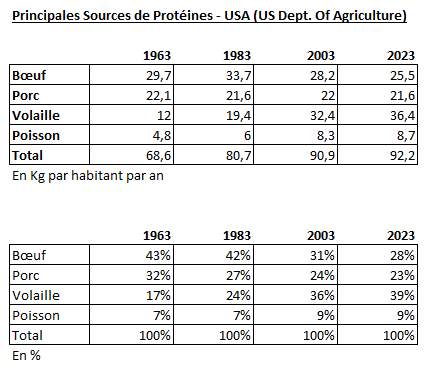

Moreover, beef remains one of the main sources of protein in the diet of developed countries. Below are the figures for the US – approximately 70 grams of beef per person per day:

Furthermore, when you add water consumption to the equation, it takes 15,000 liters of water to produce 1 kilogram of beef compared to 6,000 liters for 1 kilogram of pork and 4,000 liters for 1 kilogram of chicken (source: The Guardian).

2/ Health: Beef consumption increases bad cholesterol (LDL) and the risk of heart disease. Among all published studies, the figures from this one seem particularly explicit: a study conducted in the United Kingdom between 2006 and 2010, involving 180,000 patients, showed that those who consume a lot of red meat (>3 times per week) have a 20% higher risk of heart disease, a 50% higher risk of coronary disease, and a 100% higher risk of heart attacks compared to those who consume it less frequently (<1.5 times per week).

3/ Animal welfare: This issue is more about societal values than numbers, but there is little doubt about the general direction of increased consideration for animal rights. This is evident in public discourse as well as in legislative efforts, particularly concerning slaughter and breeding conditions.

Someone has spent a significant amount of time researching these topics and has concluded that the alternative is to offer a plant-based substitute for burgers. His name is Ethan Brown, and he is the founder of Beyond Meat. The company has garnered a lot of attention in the past three years, with a successful initial public offering in 2019 and a significant increase in value in 2021. There have been many positive developments in their business, including the introduction of the Beyond Burger at McDonald's and Kentucky Fried Chicken (KFC).

It was the moment to stay far away from the stock, which was unjustifiably valued at nearly $10 billion. Today, after a nearly continuous decline of around 90% over 18 months, things have changed. The interest here doesn't necessarily lie in the stock itself: Beyond Meat consumes money every quarter (approximately $60 million) and has limited liquidity left ($310 million as of December 31). Therefore, the risk of a capital increase is more than significant, and it was mentioned by the CFO during the last earnings presentation. So, if it happens, there will be a significant dilution for shareholders.

No, what we're interested in is a convertible bond. It's only convertible in name: issued at the peak of the bubble, it converts into shares at levels that are not worth discussing. However, it is currently valued at 25 cents on the dollar. This means that Beyond Meat has a debt of 100, and this debt is currently valued at 25. So, if Beyond Meat doesn't default, by purchasing this bond today, you will make four times your investment. That's a lot. The nominal amount is $1.15 billion, with a maturity date of March 2027 and a zero coupon.

Will Beyond Meat default? Let's be clear: a true default, where the bond is repaid below 25, resulting in a 75% haircut? The probability seems lower to me than what the price indicates. Ethan Brown is a true entrepreneur. His products have faced difficulties – no major commercial successes in various partnerships – but I believe his response is to put on his lab coat and work on improving his product to overcome these obstacles. Time Magazine named the Beyond Steak the invention of the year 2022. Big players like McDonald's or Unilever need assets to enhance their ESG balance sheets. The brand's visibility is very strong. The new alternatives – such as meat produced from stem cells – are exciting but still far from achieving significant production capacity. Regulation is favorable to Beyond Meat, and it has a massive impact, as seen in the electric vehicle industry.

In summary, I believe it's a game worth playing. We invested a small position (0.50% of the fund) on Monday.

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu