« Known knowns »

10 January 2024

Asked in February 2002 about the connections between Saddam Hussein and terrorist organisations, Donald Rumsfeld replied:

“There are known knowns, things we know that we know; and there are known unknowns, things that we know we don’t know. But there are also unknown unknowns, things we do not know we don’t know.”Traduit, ça donne: « Il y a des choses connues, des choses que nous savons que nous savons ; et il y a des inconnues connues, des choses que nous savons que nous ne savons pas. Mais il y a aussi des inconnues inconnues, des choses que nous ne savons pas que nous ne savons pas. »

At the start of this year, we are reading a lot of predictions for 2024. They all contain a lot of ‘unknowns’, i.e. things we don't know.

- What will inflation do?

- What will central banks do in each inflation scenario?

- Where will the unemployment rate go from here?

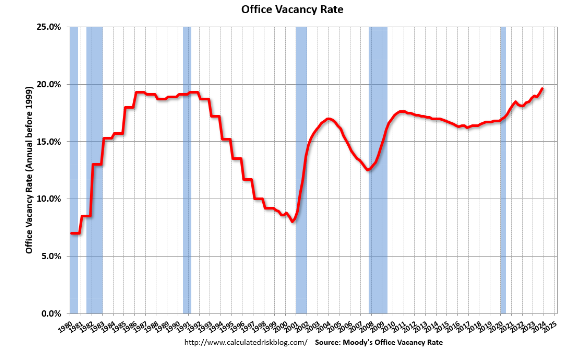

- Will there be a crisis in US office property, where the vacancy rate is at its highest (higher than during the Savings & Loan crisis of the 1980s)?

- How will the campaign for the US presidential election go?

- What geopolitical events can we expect?

The list of unknowns is long. But we can take Rumsfeld's quote in the opposite direction and focus on ‘known knowns’, i.e. ‘what we know we know’:

- The markets were driven in 2023 by the largest caps, particularly in tech, which returned to very expensive levels. Of the top 100 US/European capitalisations, 17 are paying more than ten times sales. This compares with 15 in the bubble years of 2020-21 and below 10 in the other years. So it's risky to bet on a rise in multiples for these stocks. For each stock, the price is the product of earnings and the multiple. For these megacaps, we can only count on one driver this year.

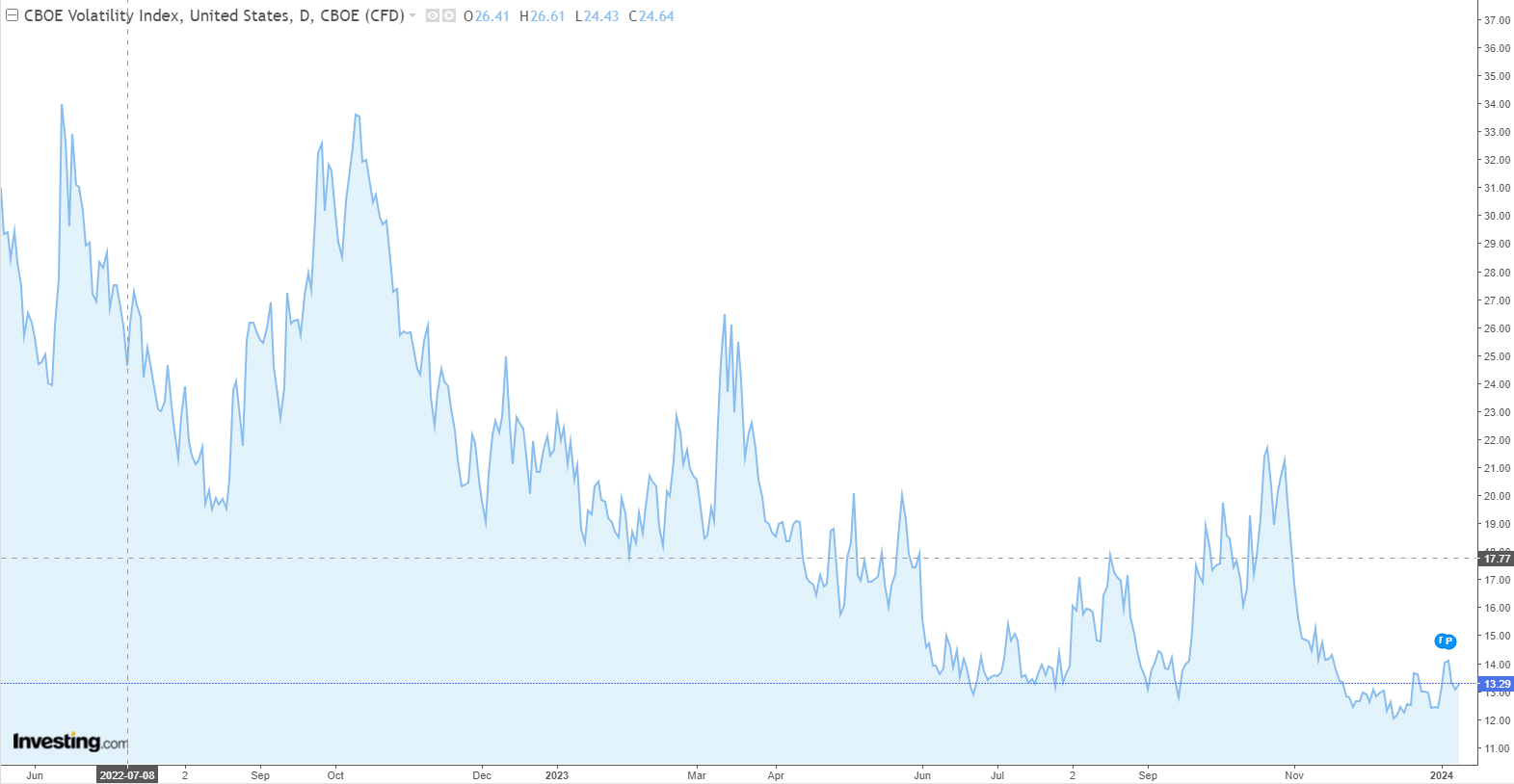

- Risk indices are at their lowest. Volatility (VIX) is at its lowest for 4 years. The VIX is low when traders do not anticipate many movements to come. It has a mean-reverting property: it falls day by day until it reaches a point where it has been too quiet for too long and it breaks down.

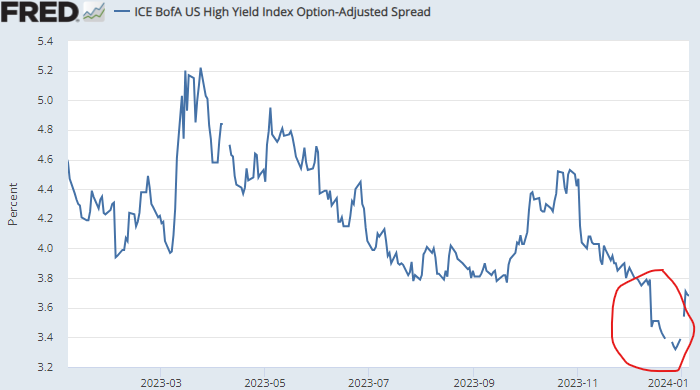

- Credit spreads on bonds are at record lows. The spread is the difference between the yield on a corporate bond and that on a government bond. Below is the chart for US high yield bonds:

The higher the spread, the more frightened the markets become. In March, at the time of the regional bank crisis, it rose above 5%. In the 2nd half of the year, optimism took over and the spread fell back to 3.8%. There was a bit of a downward bungee effect, ending on 29 December with the nicest possible prices - which helps end-of-year performance - but even after that, corrected at the start of the year, we remain very low.

So, as with equities, we can't expect these spreads to narrow by 2024: they are already at their lowest.

Here's what we know: 2024 means a lot of unknowns and, if all goes well, limited upside potential because the multiple on equities and the spread on bonds are already in the tank.

Finally, do you remember the anecdote about the boss of Sun Microsystems in 2002? Analysts asked him for an update after the stock had lost 80% of its value, and he replied, ‘Guys, you valued me at ten times sales, it was totally absurd’.

Nvidia tonight is 29 times sales.

Market and portfolio focus

Behaviour:

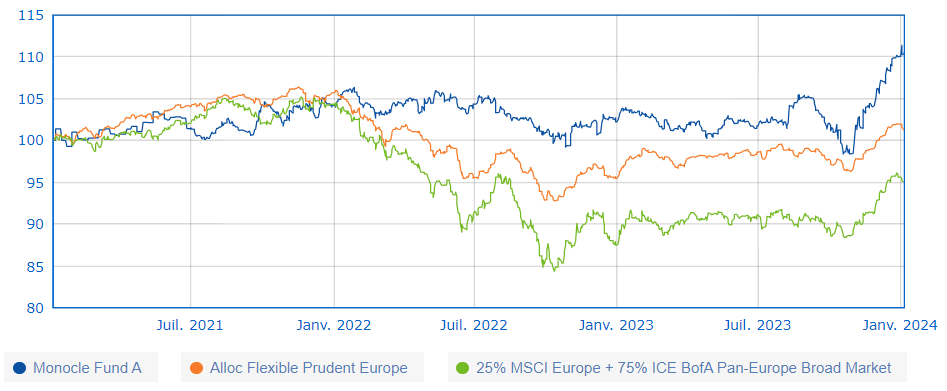

The fund ended the year up 7.67% (A share). On the chart, the end of the year looks a bit like Elton John's song ‘Rocketman’, thanks to the position in Treasuries (since closed).

It doesn't quite reach the double-digit performance level we're now aiming for. Nonetheless, I'm pleased to see that we've regained our five stars on Quantalys and above all that we are rated ‘Very Good’ for maximum loss: this has always been part of our DNA and we want to keep it that way.

On 2024, with the markets slightly in the red, the fund is currently positive for the start of the year at +1.0%, driven by Biontech and WK Kelloggs.

Lines:

We have just bought back 5% of LVMH, after a 7% fall since the start of the year: among the mega caps, this is one whose valuation is not out of kilter. Yesterday we also bought a 4% bond on Valaris maturing in 2030, which offers a yield of 8% in USD. Valaris went through a restructuring in 2020, so it still has a whiff of sulphur that is scaring off some investors. However, during the restructuring, its debt increased from $8bn to $1bn and, at the same time, the oil majors had to reopen their exploration budgets, which meant leasing Valaris' platforms. After these purchases, the equity exposure is 40%, with corporate bonds at 17%.

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu