THE FIRST VEHICLE TO BE AUTONOMOUS BEFORE THE END OF THE YEAR

12 June 2024

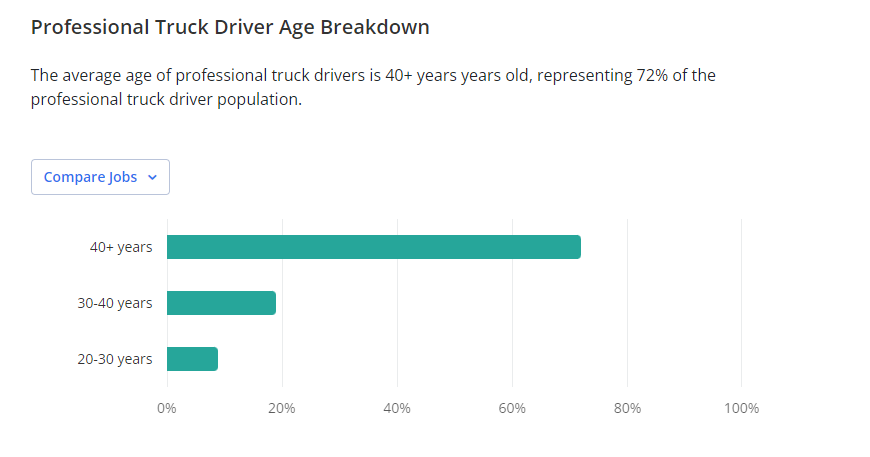

1/ The population of truck drivers in the US is elderly.

Age of truck drivers

Source : Statista

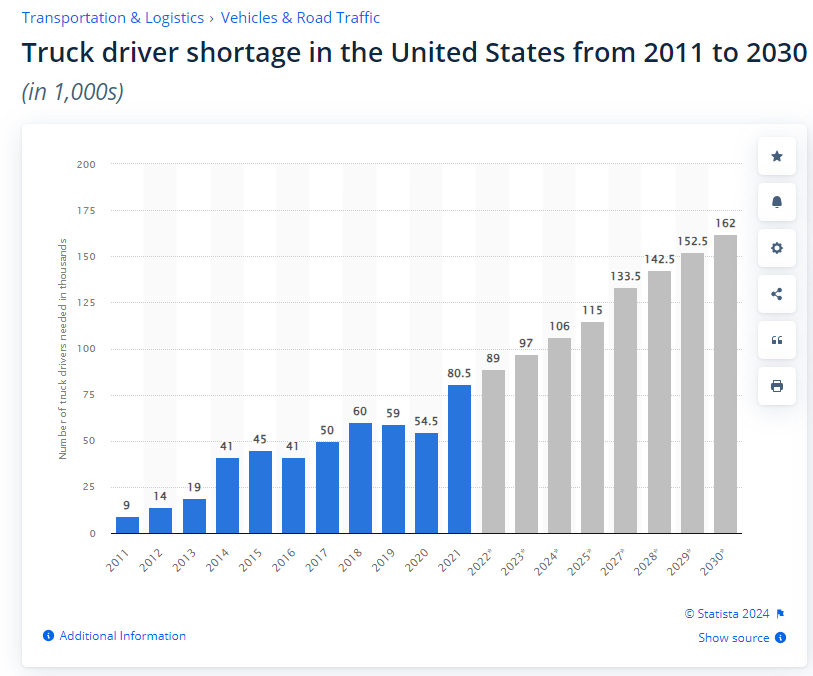

2/ It is old because young people no longer want to spend twelve hours in a truck - especially as it's no longer acceptable to stick Playboy cut-outs in the cab.

Shortage of truck drivers in the US from 2011 to 2030

Source : Statista

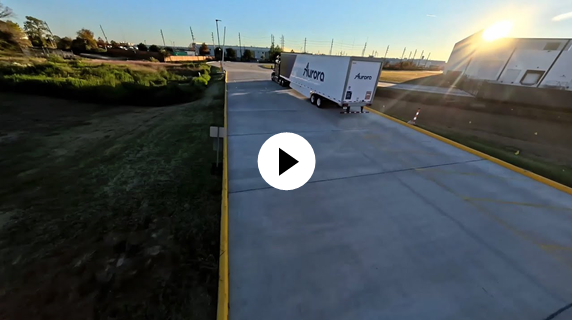

3/ The solution is this:

The autonomous truck developed by Aurora. The principle is simple: Aurora sets up bases across the United States. The truck connects the bases by autonomous driving, and once it arrives, a driver takes over and provides the local service.

4/ There are many players in the autonomous driving sector. Why this one?

Because the team is not the same as elsewhere :

Sterling Anderson, Chris Urmson and Andrew Bagnell

- Chris Urmson, former head of the autonomous driving team at Google/Alphabet Inc (known as Waymo).

Urmson has more than 15 years' experience in managing automated vehicle programmes. Before founding Aurora, he helped develop Google's autonomous driving programme.

Urmson holds a PhD in Robotics from Carnegie Mellon University and a Bachelor of Engineering in Computer Engineering from the University of Manitoba.

- Sterling Anderson, former head of Tesla Autopilot, has spent more than 12 years leading advanced vehicle programmes. Prior to founding Aurora, he led the design, development and launch of the Tesla Model X and oversaw the Tesla Autopilot team. In the late 2000s, he developed MIT's Intelligent Co-Pilot software, which led to major advances in autonomous driving.

He holds several patents and more than a dozen publications on autonomous vehicle systems. He holds a master's degree and a doctorate from MIT.

- Drew Bagnell, former head of Uber's autonomy and perception team.

Co-founder of Aurora and a consulting professor at Carnegie Mellon University, he has over twenty years' experience in robotics and automation. His research group has won more than a dozen awards at major conferences in the field.

He holds a doctorate in robotics from Carnegie Mellon and a bachelor's degree in electrical engineering from the University of Florida.

Lastly, we have Uber, Amazon and Toyota as shareholders, and Volvo and Paccar as preferred partners.

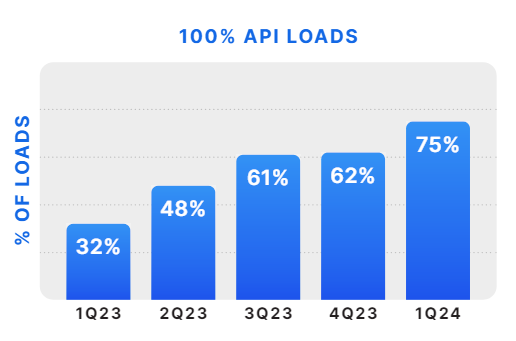

5/ When will it be available on the market?

When the "Aurora Performance Indicator" (API), which indicates the % of journeys completed without the need for intervention will have reached 90%..

Below you can see how fast this indicator has risen over one year:

Aurora Performance Indicator

Source : Aurora Innovation

"Since September 2021, we have autonomously delivered (under the supervision of operators) 5,450 loads, covering around 1.5 million commercial kilometres, with a punctuality rate close to 100% for our customers. [...] While we are preparing for the commercial launch, continuing to transport freight autonomously for all our pilot customers, including FedEx, Werner, Schneider, Hirschbach and Uber Freight. We are currently scheduling around 120 commercial loads per week, which is three times the commercial volume we were handling a year ago."

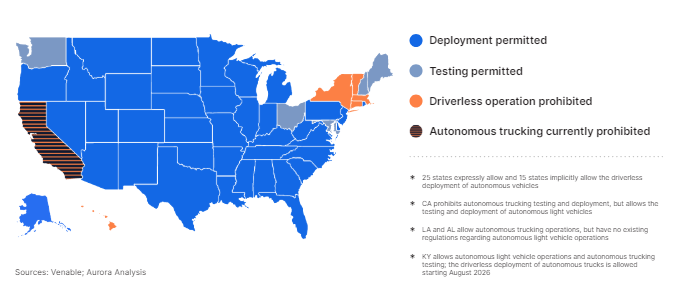

6/ The regulation is validated

7/ How is a company like this valued?

The accounts are simple no revenues (solution not yet commercialised). Cash $1.0bn, no debt, consumes $150m per quarter. Capitalisation $3.6bn.

It's important to remember that it doesn't yet generate any sales., so it's not a Danone stock! Volatility is very high (90%). But it's a great long-term story with an outstanding team. Position in the fund: 2%.

Market and portfolio focus

Behaviour:

From 31 May to 7 June, the fund gained 0.45%, while the CAC 40 and S&P 500 gained 0.11% and 1.32% respectively.

There was quite a bit of movement in US long rates last week. We did increase our futures position when they approached 4.8%, which paid off this week with a 90bps contribution. We sold the line when rates fell below 4.5% before resuming a smaller position yesterday (15% exposure).

We lost just over 30bps over the week in our equity pocket. Two lines stand out. The first is Five Below, which we bought on the day it fell below $110: a 30bps contribution. The other is Tidewater, which specialises in offshore oil services. The stock followed the oil price and cost us more than 30bps, which was largely recouped yesterday - +13% - when the stock's inclusion in the S&P 600 was announced.

We ended the week with a gross equity exposure of 54% (net 39%) and a corporate credit and US short-term interest rate exposure of 28%.

Lines:

We've decided to increase the exposure of our equity pocket this week, so there's been quite a lot of movement.

Firstly, we have strengthened some of our existing positions.

Berry Global, Lamb Weston and Pernod Ricard were each raised to 4%, as was Lululemon once the momentum of its very good results had died down a little. We took advantage of the fall in oil to raise Tidewater to 6% when it was still below $95 - we benefited from yesterday's rise. Lastly, we doubled up on smaller lines with huge opportunities: Affirm, Aurora and Duolingo now each weigh 2%.

At the same time, we added six new positions. We put 4% into Five Below (American discount retailer) - following its post-results swoon - and into Brembo, the Italian brake specialist. We added 2% to four other companies: Olin - a leader in the production of chlorine and caustic soda; U-Haul - a specialist in removal vans in the US; Marr - Italy's #1 food retailer for professionals; and Grab - a sort of Uber for South-East Asia.

On the exit side, we're turning over a new leaf. We had been invested in Biontech for some time because we felt that the value of the Covid franchise was not reflected in the share price. Our thesis has unravelled as the Covid news waves have receded. Fears about the new avian flu in the United States have caused the stock to rebound in recent weeks, and we took advantage of this to sell our position at these levels.

We now have a gross equity exposure of over 55%. At the same time, we have taken out insurance in the form of an S&P 500 short, which brings our net exposure down to 39%.

See you next time

Charles

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu