Extrapolation

11 July 2024

The SP500 is up 18%. since the start of the year, driven for the most part by a handful of megacaps. The market is paying increasingly high multiples on these because it anticipates significantly higher future profits thanks to the development of AI..

Knowing whether they are right or wrong is a difficult exercise What will be the adoption rate of this new technology, its financial impact, development costs, societal impact and possible reactions?

It was the same thing in 2000 with the internet. And few managers fared well: those who said it was a bubble had only a handful of clients by 1999. Those who said the opposite disappeared after 2000.

We can try to look at the problem from another angle: why not look at the valuation of companies that are sufficiently far removed from the major issues of the day - the internet then, AI now?

For 2000, we won't be looking at ‘server’ or ‘software’, but at ‘soda’, ‘basketball’ and ‘supermarkets’. The Internet revolution should normally have little effect on businesses such as Coca-Cola, Nike or Costco.

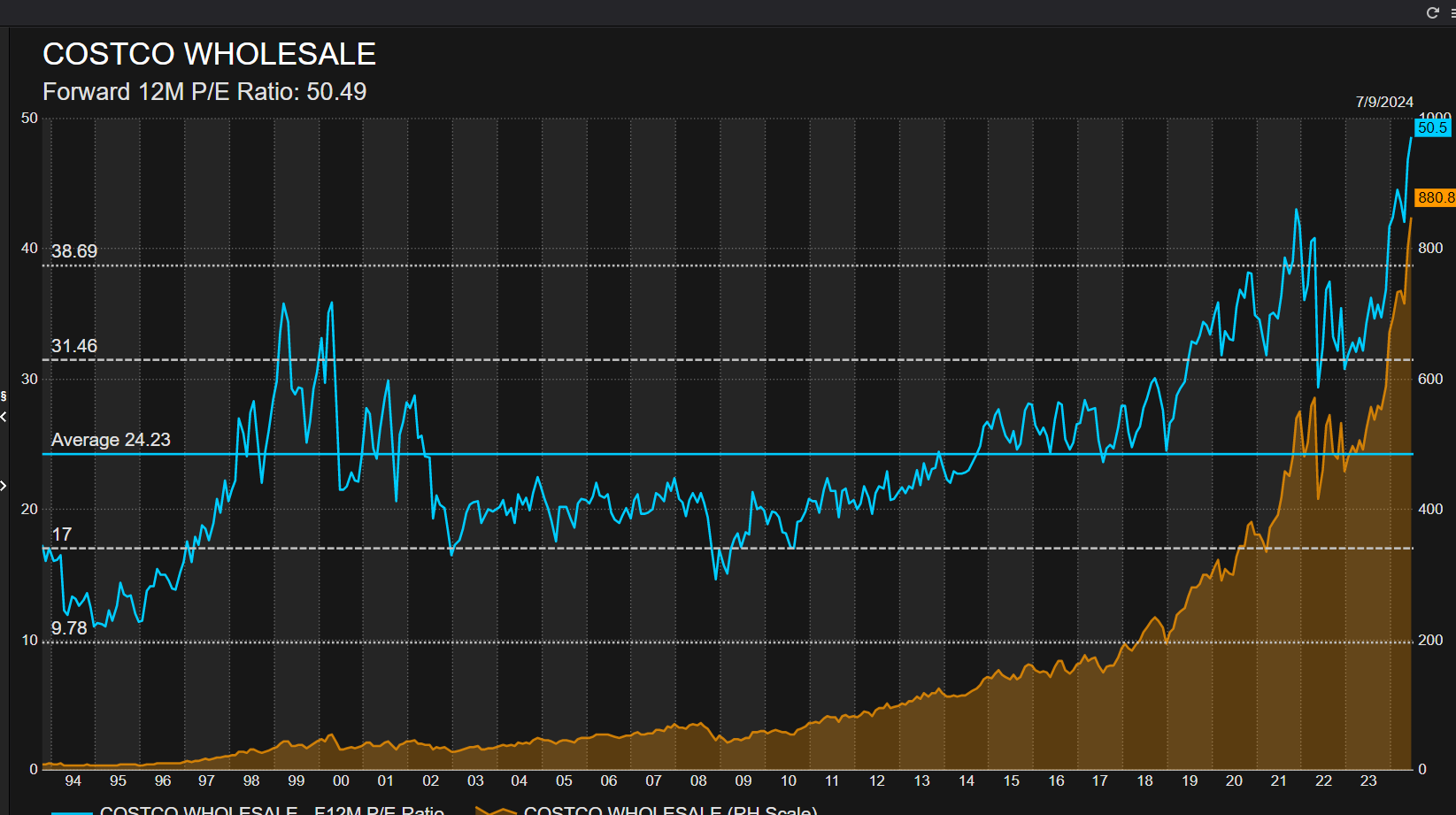

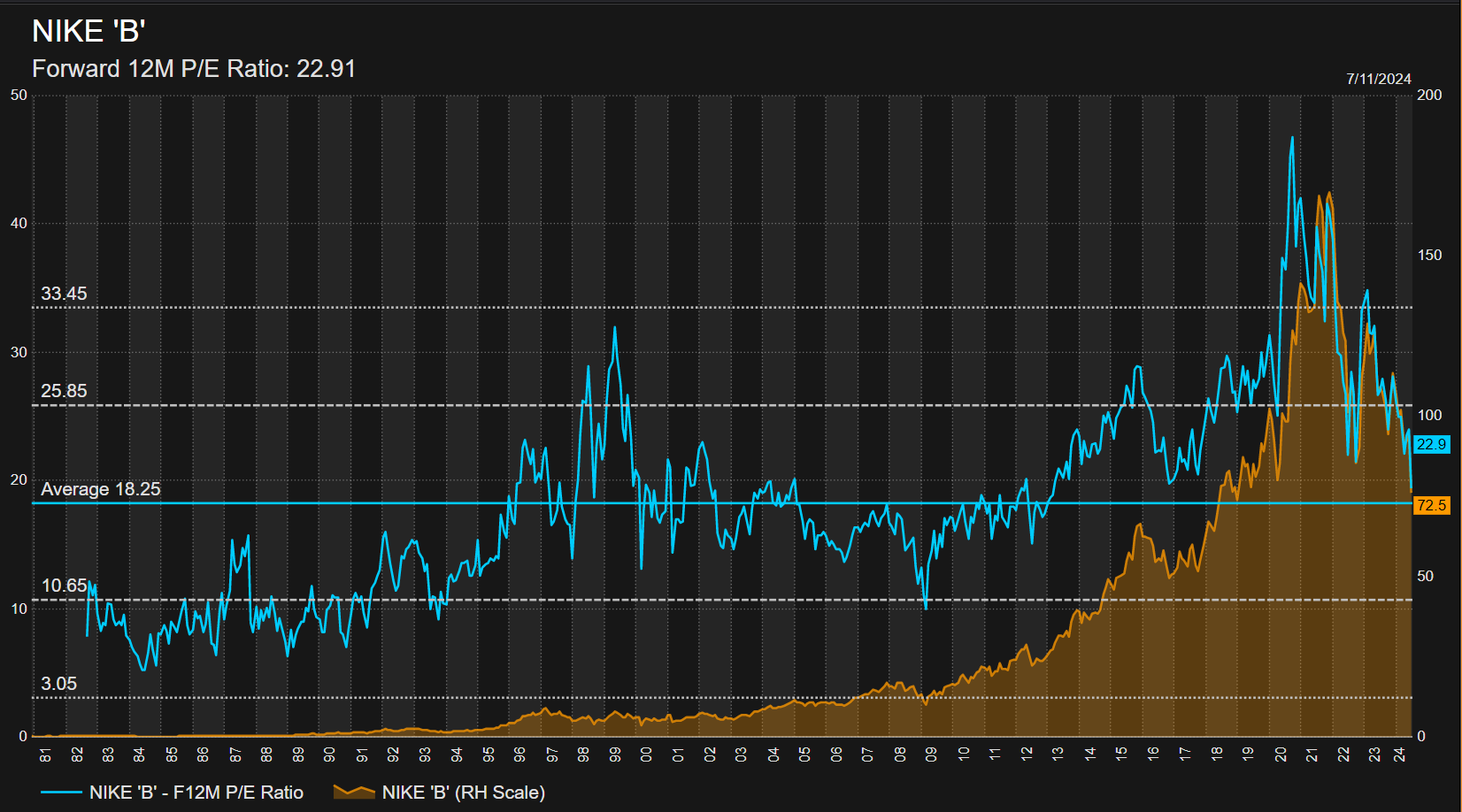

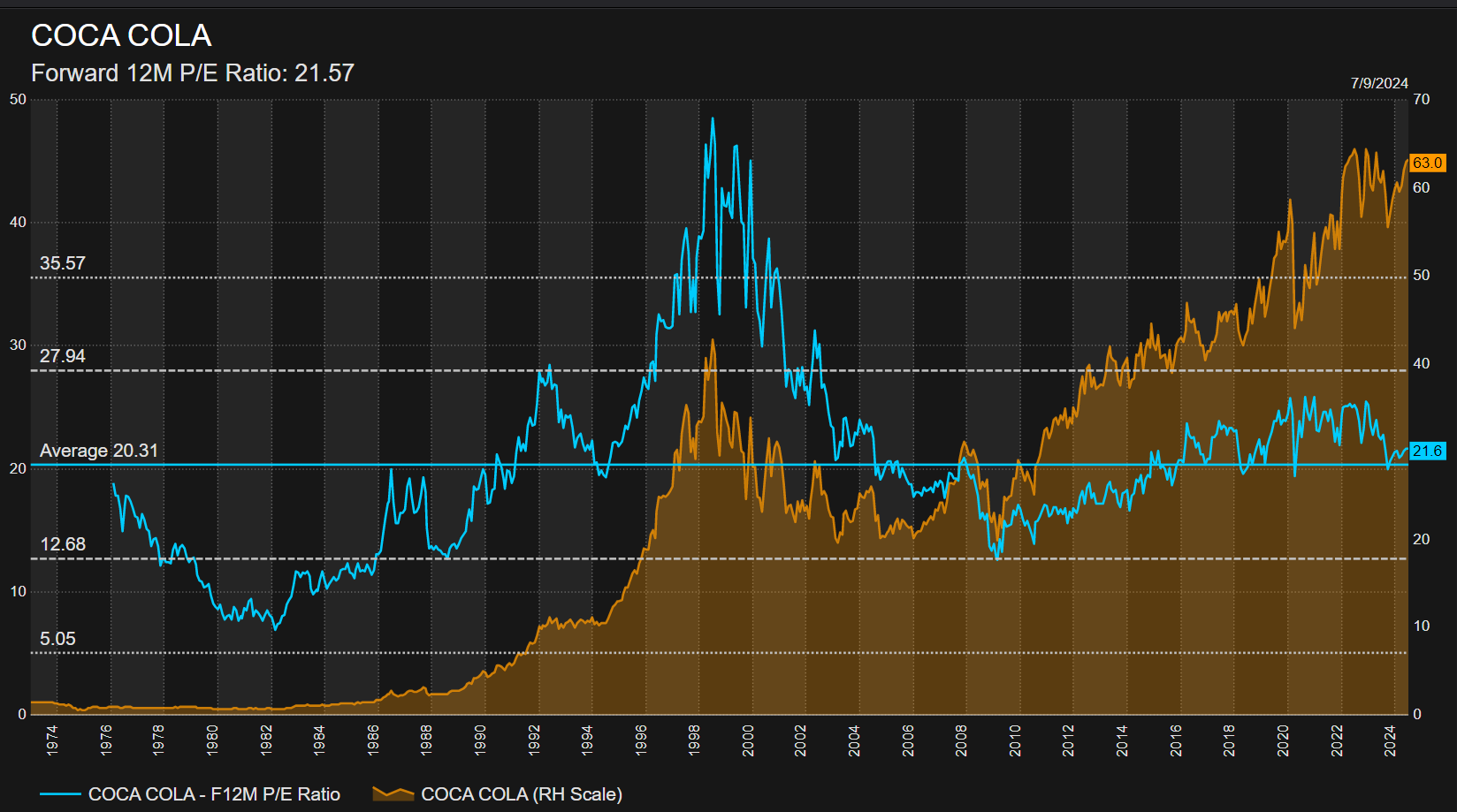

However, the PE forward multiples of these companies doubled between 1995 and 2000: Coca went from 20x to 49x, Nike from 12x to 28x and Costco from 17x to 31x.

In fact, the market has decided to pay twice as much for the same business as before.

Le 8 février 2000, Nike avertit :

"Nike said profits for the fiscal year ending May 31 would be slightly below the $2.08 per share expected by analysts polled by First Call/Thomson Financial. The company also said that next year's profits would rise by less than the 20% expected by analysts. Of the 19 analysts who follow the stock, 9 had strong buy recommendations on the stock before yesterday and another 3 had rated the stock a buy." (New York Times)

The share price lost 18% during the session. We will have to wait 3 years to review its entry price.

Three months later, on 24 May 2000, Costco published results that were slightly worse than expected. Earnings per share were 1 cent below analysts' estimates for the current quarter, and the forecast for the following year was lowered by 2 cents.

This minor revision caused the share price to fall by 22% in one day and 40% in one month. Five years later, the Costco share is still trading at levels 25% lower than before the publication.

The story is the same for Coca-Cola - we had to wait 13 years to see its entry price at the top in 2000.

What can we conclude from these facts of twenty years ago?

> The overvaluation of companies not affected by the Internet in 2000 shows that it was indeed a bubble.

> We can extrapolate that if traditional companies were valued at 2x too high at the time, we can intuitively assume that Internet companies were valued at 4x too high. This is consistent with the Nasdaq falling by 80% at the time.

> These twenty years have been enough to dissolve the collective memory and the market is doing the same thing all over again. Nike was paying 50x earnings not so long ago, Costco is paying more than 50x today. These companies have nothing to do with AI. If they are once again valued at twice the price, then intuitively a 4x premium on AI-related companies makes sense.

And finally, ‘the proof is in the pudding’ as the old saying goes:

A fortnight ago, on 27 June, Nike published slightly disappointing results. The share price fell by 18% during the day. Elle se traite désormais à $75. Elle cotait $175 en novembre 2021.

Its multiple at the time was... 51x.

So Costco published its monthly sales figures last night. Sales were up 6.9% for the month, and the company announced, for the first time in 7 years, an increase in its annual subscription*. In response, the market took the stock above $900 and the multiple solidly above 50x. 60% higher than in 2000.

So for the time being, there's nothing to worry about. But as we've just seen, history tells us that it would only take one grain to make a big difference.

* Change in Costco subscription price:

1983 – 25$

1992 – 30$

1995 – 35$

1998 – 40$

2000 – 45$

2006 – 50$

2011 – 55$

2017 – 60$

2024 – 65$

PE Forward – Costco Wholesale

Source: Reuters

PE Forward – Nike

Source: Reuters

PE Forward – Coca-Cola

Source: Reuters

Market and portfolio focus

Behaviour:

From 28 June to 5 July, the Monocle lost 0.2%, while the CAC gained 2.6% and the S&P 2.0%.

Overall, our equity portfolio was in balance this week. Teleperformance benefited greatly from the rebound in the CAC 40, adding 40bps. Five Below and Lamb Weston partly wiped out this gain following earnings releases in their sectors. Each cost us around 15bps.

Finally, the position on Bunds futures that we had taken as insurance before the elections was cut after the results. It cost us 20 bps over the week.

Lines:

No changes in our lines this week. Our gross equity exposure remains at 52%, and our net exposure at 40%.

On the bond front, last week we mentioned the main change: our position in US long yields. We remain 32% exposed to this line. On the corporate bond side, good opportunities remain rare, so our exposure remains unchanged at 13% (average yield of 8.5%).

Have a great weekend,

Charles

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu