Beware Of the Multiple

30 July 2024

Three years ago, we were at the same time preparing for the Patrimonia convention.

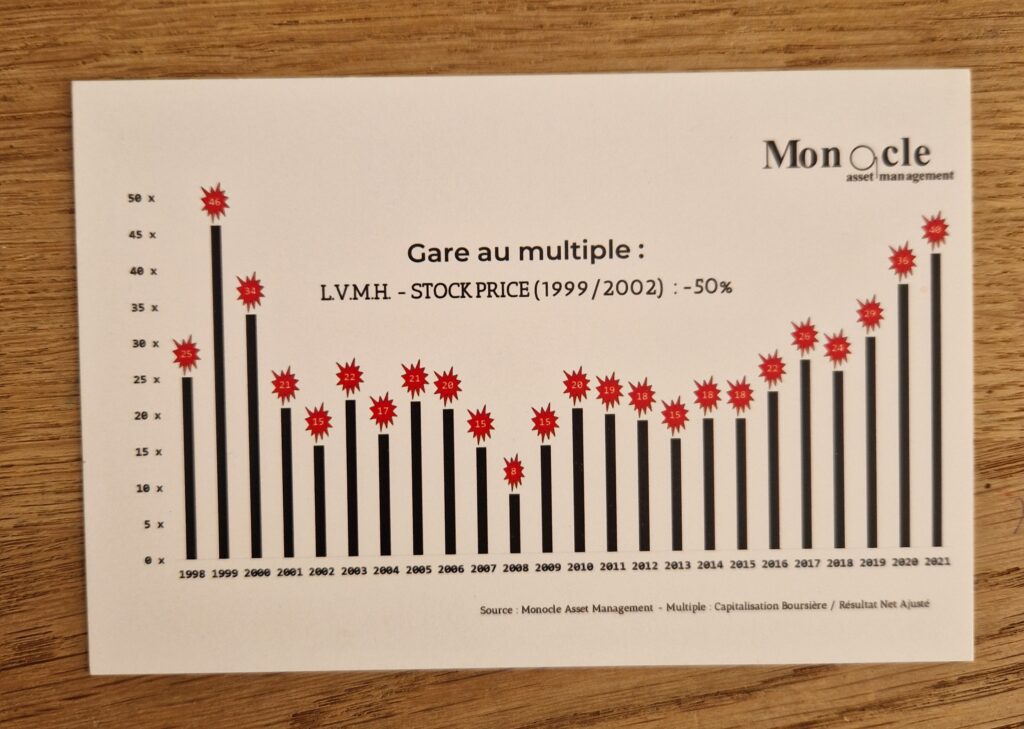

To do this, we were printing the following postcard:

This postcard showed the evolution of the adjusted multiple for the LVMH share. The level reached in 2021 frightened us, hence our title of ‘’Beware of the Multiple‘’.

At the time, LVMH shares were worth €680. As it is currently quoted at €660, anyone who has held LVMH statically over the three years has a yield of around 0%, including small dividends.

[Note: we were handing out a second postcard with the multiple of Dassault Systèmes, which today is 30% lower than its share price at the time - come to our stand at Patrimonia, we don't have any champagne but we do have ideas!]

Today we once again have a position in LVMH. So some people say to me, ‘But Charles, if you're going to have LVMH, you might as well buy an ETF.

If you don't move the line no matter what, you might as well buy an ETF. But ‘flexible fund’ includes ‘flexible’... We already had LVMH at the beginning of the year. And when we went out at the beginning of February, I wrote in the post at the time:

"At the end of last week, the fund benefited from our large position (9% of the fund) in LVMH (1.5% contribution). We've halved it since then: at €660 it was a bargain, at €770 it's OK, and above €850 it's starting to look like a lure."

If the business/environment does not change, this reasoning remains valid. We sold our last shares at €820 at the end of February. Now back down 20%, the stock is once again attractive.

1/ In forward multiples, we are back towards the bottom of the range. This means that if you buy LVMH today, you are paying relatively little for it historically.

2/ In terms of price movements, each share has its own characteristics. LVMH has a historical volatility of between 18% and 33% (52 weeks) and if we look year by year, the maximum fall in a year between the top and the bottom (‘the max drawdown’) is around 20% - except in crisis years such as 2008:

2007: -12% Peak: 80.15 (29-Oct-07) Bottom: 70.3 (21-Nov-07) Nb days: 23

2008: -52% Peak: 73.99 (02-Jan-08) Bottom: 35.32 (21-Nov-08) Nb days: 324

2009: -19% Peak: 44.57 (06-Jan-09) Bottom: 36.05 (19-Jan-09) Nb days: 13

2010: -12% Peak: 81.58 (15-Apr-10) Bottom: 71.66 (07-May-10) Nb days: 22

2011: -25% Peak: 117.66 (25-Jul-11) Bottom: 88.13 (04-Oct-11) Nb days: 71

2012: -18% Peak: 122.03 (16-Mar-12) Bottom: 100.67 (04-Jun-12) Nb days: 80

2013: -17% Peak: 129.06 (21-May-13) Bottom: 107.47 (24-Jun-13) Nb days: 34

2014: -15% Peak: 131.53 (30-May-14) Bottom: 111.53 (16-Oct-14) Nb days: 139

2015: -21% Peak: 175.6 (05-Aug-15) Bottom: 139.3 (24-Aug-15) Nb days: 19

2016: -18% Peak: 159.5 (14-Mar-16) Bottom: 131.4 (27-Jun-16) Nb days: 105

2017: -11% Peak: 238.1 (05-May-17) Bottom: 212.7 (31-Jul-17) Nb days: 87

2018: -22% Peak: 311.7 (21-May-18) Bottom: 243.25 (10-Dec-18) Nb days: 203

2019: -11% Peak: 385.6 (26-Jul-19) Bottom: 343.25 (05-Aug-19) Nb days: 10

2020: -34% Peak: 439.05 (17-Jan-20) Bottom: 287.95 (18-Mar-20) Nb days: 61

2021: -14% Peak: 712 (12-Aug-21) Bottom: 613.1 (19-Aug-21) Nb days: 7

2022: -29% Peak: 758 (05-Jan-22) Bottom: 539.4 (16-Jun-22) Nb days: 162

2023: -27% Peak: 902 (24-Apr-23) Bottom: 660.6 (13-Oct-23) Nb days: 172

2024: -25% Peak: 872.8 (14-Mar-24) Bottom: 652.6 (25-Jul-24) Nb days: 133

Returning today after a 25% drop since the top in mid-March means having the stats with you.

3/ LVMH is one of the largest capitalisations in many indices, including the CAC40. Every time an investor switches from active to passive management, they automatically buy LVMH (because their previous portfolio generally held less LVMH than the index). This daily flow can be compared to a leak: it is a small force that pulls the share price upwards every day.

4/ Finally, the fundamentals of the latest results were correct. Fashion & Leather Goods - which accounts for 75% of profits - is holding up well, with organic growth of +1% for the first half following last week's publication.

All this put together, we have an 8% position in the fund on LVMH today because I think the probabilities are with us. This does not mean that I am certain that this operation will work. But in the long term, if we carry out a multitude of operations with such probabilities, the expectation of the total is positive.

Market and portfolio focus

New idea

Talking of probability and expectation, I looked at what clever things could be done with this idea in structured products. For those who don't know, structured products are bonds issued by banks - eg BNP - that provide you with a different return depending on different scenarios for one or more underlyings - in this case the LVMH share.

There are a lot of players in this market, but I thought I might be able to move the schmilblick forward by bringing some know-how with

1) stock picking - using the above reasoning

2) on the options skills that make up the engine of the structured product - in my first professional life I used to set up strategies and tools for currency options.

I've won a few prizes and I've come up with solutions that would give coupons of 10% over three years in scenarios that seem reasonable to me. Just to be clear, these products won't be included in the fund - you need the aptly named ‘complex products’ authorisation from the AMF, which we don't have - but I'd be happy to discuss them with anyone interested in providing expertise and advice on these products. So if that's the case, drop me a line and I'll organise a call/webinar on the subject.

Market

A week of ‘Cambronne's word’ on the markets, which shook things up quite a bit. We had another bad report on Lamb Weston and Thursday shook most of our lines. Things picked up a little on Friday, but we gave back a good part of our annual performance. The violent reactions on some of our lines led me to adopt Michael Steinhardt's* method at the end of the week.

["Now that you only have cash, do you want to buy XYZ shares again at $100?]

He managed his Steinhardt Partners fund in the 1980s, and when he felt the portfolio was not doing well, he would order his teams to sell everything. Once that was done, everyone started from scratch.

At Monocle we were not as radical, but we did sell Brembo, Berry Global, Olin and Pernod Ricard, as well as half of Lamb Weston and Tidewater. All in all, after all these reductions, our net equity exposure was 27% at Friday's close.

I also exited our position in US long rates with a profit of over $800k on this operation. The US 30-year is back at 4.40%, which is no longer an extreme level, and it is increasingly difficult to see clearly on the macro front: the changes in the US elections and recent developments in many indicators - the fall in copper, the rise in the yen, the fall in oil, the rise in volatility, etc. - are reducing visibility. Along the same lines as what I said about LVMH at the start, here the probabilities are starting to be low enough for caution to prevail over greed.

Publications from 4 of the Magnificent 7 this week: we're following along - as always - and we'll give you a recap in the next post.

The "Man-facing-AI" minute

Answer to last week's game.

You had to build a pyramid!

This week's question: Three ants are standing at the three corners of an equilateral triangle. Each ant chooses a direction at random and starts to move along the edge of the triangle. What is the probability that none of the ants will collide?

Post-Scriptum

On autonomous driving, 12 seconds to see how it handles an unexpected double (here Waymo, a Google subsidiary).

I think that in a few years' time, the regulator will only accept a human driver if a robot is ready to take over at any moment.

Have a great week,

* For those who like it, I recommend his autobiography ‘No Bull: my Life in and Out of Markets’ (2001) - not to be confused with Maggy Mahar's ‘Bull’, which is another excellent book about the bubble of 2000.

Charles

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu