Volatility, retracement and a lesson from 94 years ago

14 August 2024

The SP500 peaked on 16 July at 5667. Volatility (VIX) was 13.1%.

The correction that followed took the index down to 5119 on 5 August, before closing at 5186.

On 5 August, the VIX rose above 65.

In the last ten years, there have been 3 precedents of this magnitude:

- Monday 24 August 2015, when the SP500 suffered a flash crash, losing 5% within minutes of opening. That morning, it was not the Nikkei but the Shanghai Index that lost 8.5%.

- on 06 February 2018, ‘Volmageddon’, which saw the bubble of strategies that sold volatility burst - some products lost 90% on the day.

- 04 March 2020, start of the pandemic.

These events had different origins and the markets moved differently after them.

There is, however, one common characteristic: after the crash, on the one hand we saw lower prices each time, and on the other, it took some time to see significantly higher indices again.

In 2015 it took a year, and it took -14% in February 2016 to start climbing again.

In 2018, the low was -18% on 26 December, and it will be more than a year (April 2019) before the high is breached again.

In 2020, we went through a clear low very quickly, touching -25% since the peak a fortnight later, and we will have to wait until November - and in a context of particular liquidity injections - to see higher.

One attempt at a theory - for what it's worth - is that the immediate reaction is :

‘This day of crisis was just an accident, nothing has changed’, but at the same time a day like this brings about change: the return of fear. This is slowly creeping into the thinking of operators, who are participating, yes, but taking their profits a little faster - so no higher highs - and finally starting to protect themselves.

All this to tell you that I have very moderate confidence in the SP500's rebound in recent days.

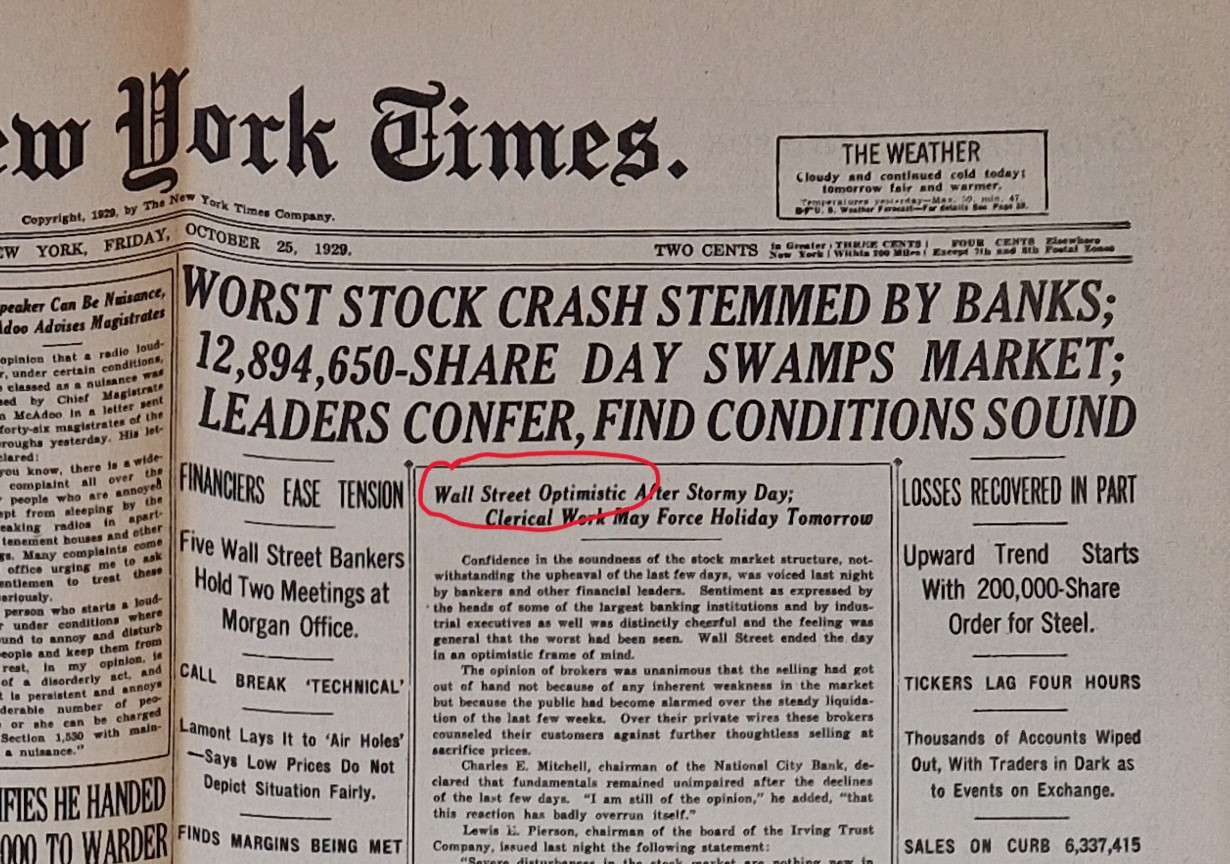

The structure of today's markets is, as it has always been, different from that of yesterday. But human nature is not changing much. I found the article below in a bookshop this weekend. It's from the New York Times and dates from 1 October 1929, three weeks before the collapse. It could have been written yesterday.

NEW YORK TIMES, October 1st, 1929

‘Three different positions seem to be adopted with regard to the financial future.

According to the first, we have now undoubtedly discovered the existence of a new financial and industrial era, in which the old rules have been completely abrogated and past experience has nothing to teach us worthy of consideration.

According to the second, the recent trend of business in industry and on the speculative markets cannot last; the reversal, when it occurs, could be severe and of a violence comparable to that of the interrupted upward movement, but no one can fix the moment and the conditions of this change.

The third view, probably held by the majority of the financial community, is that reasoned judgements have been disproved so often over the past three years that it is better to stop making them in the short term and that, whatever one's deeply held convictions, it is better to go with the flow, while keeping a close eye on the distant horizon.

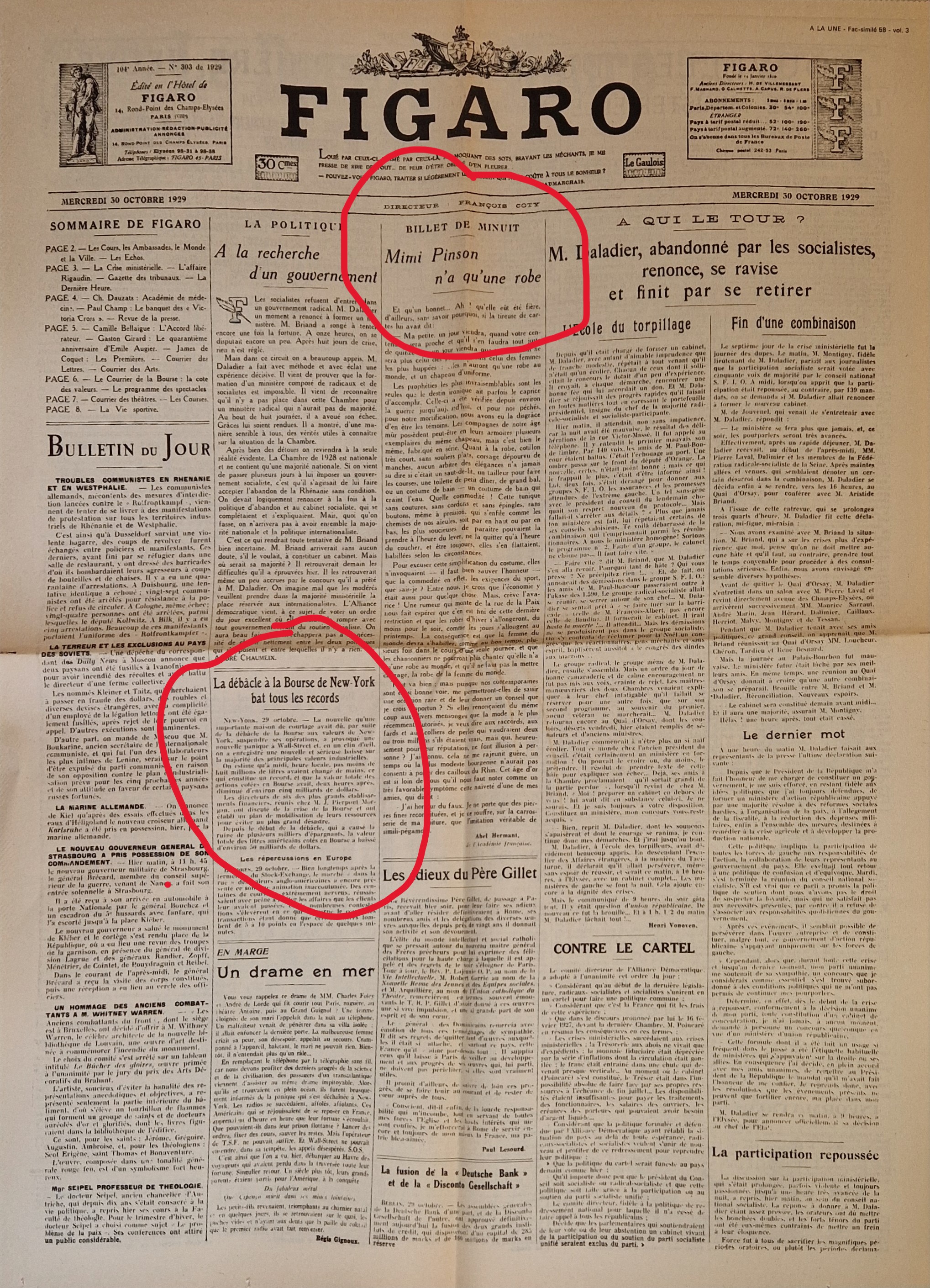

The front page of Le Figaro the day after the crash - the article is a third of the size of the one about Mimi Pinson's dress...

Market and portfolio focus

Market positioning

Reducing equity exposure: the fundamentals of these markets are unforgiving. So you need an extra degree of certainty to keep your exposure. We therefore opted to exit Lululemon, Nike, Five Below and Tidewater. And to reduce Ouster before its publication last night - decent results but the stock is still down 17%: as I was saying, these are markets where fear takes over.

Our gross equity exposure is 18% and our net exposure is 16%.

Portfolio

Over the week from 2 to 9 August, the Monocle lost 0.3%, the CAC gained 0.2% and the S&P 500 was flat.

Duolingo's publication was a good one, with sustained growth figures (40% increase in sales) and the number of monthly users now exceeding 100 million. The stock has gained around twenty per cent since the publication and is now reporting over 30bps.

The main detractors this week, between 10 and 15 bps, were Ouster, Five Below and Aurora Innovation - with no specific news on these stocks.

AI training of the week

Two puzzles to choose from, depending on your performance this year - given ours, we'll take the first:

‘At Dédé's, the dish of the day + half is worth €25.0 and the dish of the day is worth €20.0 more than the drink. How much is the demi worth?’

Or

‘At Caviar Party, the caviar + vodka menu is worth €110.0 and the caviar is worth €100.0 more than the vodka. How much is the vodka worth?’

Have a good week,

Charles

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu