Explanations

23 August 2024

This week, after receiving a number of requests, the note details the fund's performance since the beginning of July. These questions are more than normal: performance (A share) rose from +0.7% on 9 July to +5.9% on 16 July, before falling back to -1.8% on 5 August. We are now at -0.2%.

First the outward journey: here are our main contributors between 9 July and 16 July

> Our position on US long rates yielding 0.6%.

> Aurora (autonomous truck driving) gained +68%

> Ouster (lidar manufacturer) +41%

Tidewater (oil services) +15%

> Berry Global (packaging) +11%

> Affirm (fintech) +18%

In all, we gained 5.20% over the week.

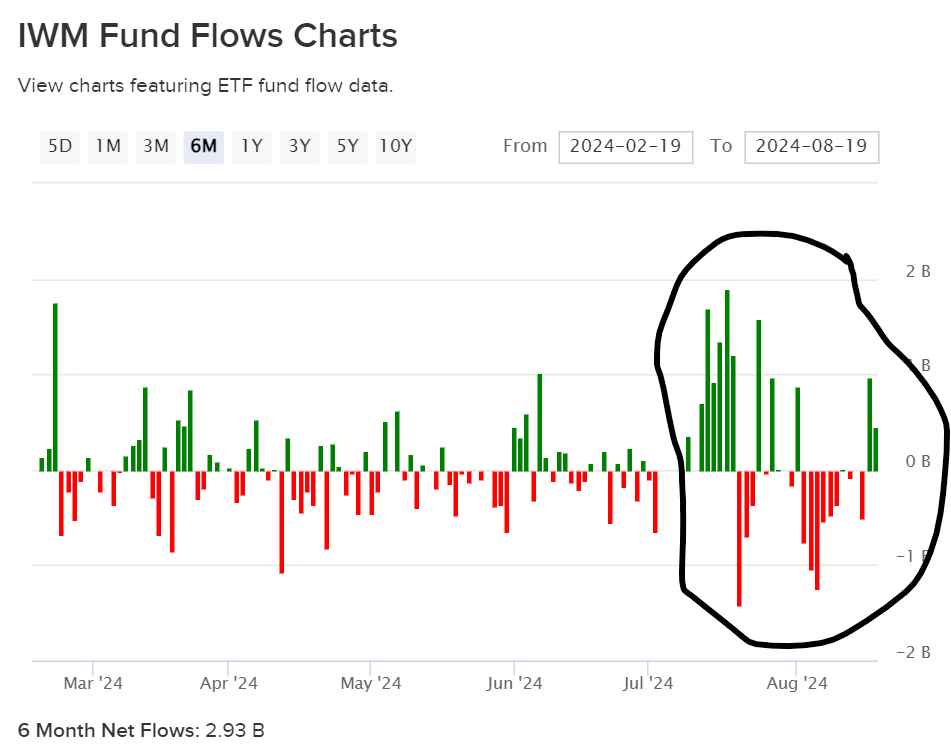

With the exception of Aurora - which remains 30% above its price at the beginning of July - these movements did not reflect a craze for these particular stocks. Rather, they reflected an inflow into US small caps. Their index - the Russell 2000 - gained 10% over the week, while the SP500 stalled. This is clearly seen below in the inflows/outflows into the Blackrock IWM US Small Cap ETF (AUM: $66bn).

ETF IWM – BlackRock

And you can already see from the graph above that this trend, for which no one knows the real reasons*, has rapidly reversed.

With the exception of Aurora, where given the scale of the movement we sold half our holdings at the top, we did not touch the rest of our positions because our price targets were higher.

The backlash was violent.

First, on 16 July, Five Below (3.6% of the fund) warned that its results would be below expectations and that the CEO - in post since 2015 - was leaving the group. The market did not like this and the share price fell by 25% in one session. We had, however, taken a margin on our entry price: at $110, it was half of what Five Below was trading at the end of 2023. This margin of error proved insufficient.

Then, on 24 July, we took a second beating with Lamb Weston (3.7% of the fund), McDonald's Chips supplier. Against a backdrop of flagging demand, the group announced that it was cutting its prices and thus drastically reducing its results. After a historic fall on the day itself, the situation calmed down a little in the days that followed, but the share price was still 20% below its pre-earnings price.

After this second slap in the face, which knocked us off our pedestal, we took up the theses of our lines one by one. And Antoine and I decided to take out the lines where the risk had increased.

This included :

- Tidewater, whose CEO had just sold 85% of his shares

- Lululemon, because growing beyond $10 billion in revenue will be a difficult step (in the US, Lululemon already sells 1 pair of yoga trousers when Nike sells 3 pairs of trainers, so it will be difficult to do more).

- Ouster, for half the position, before the results.

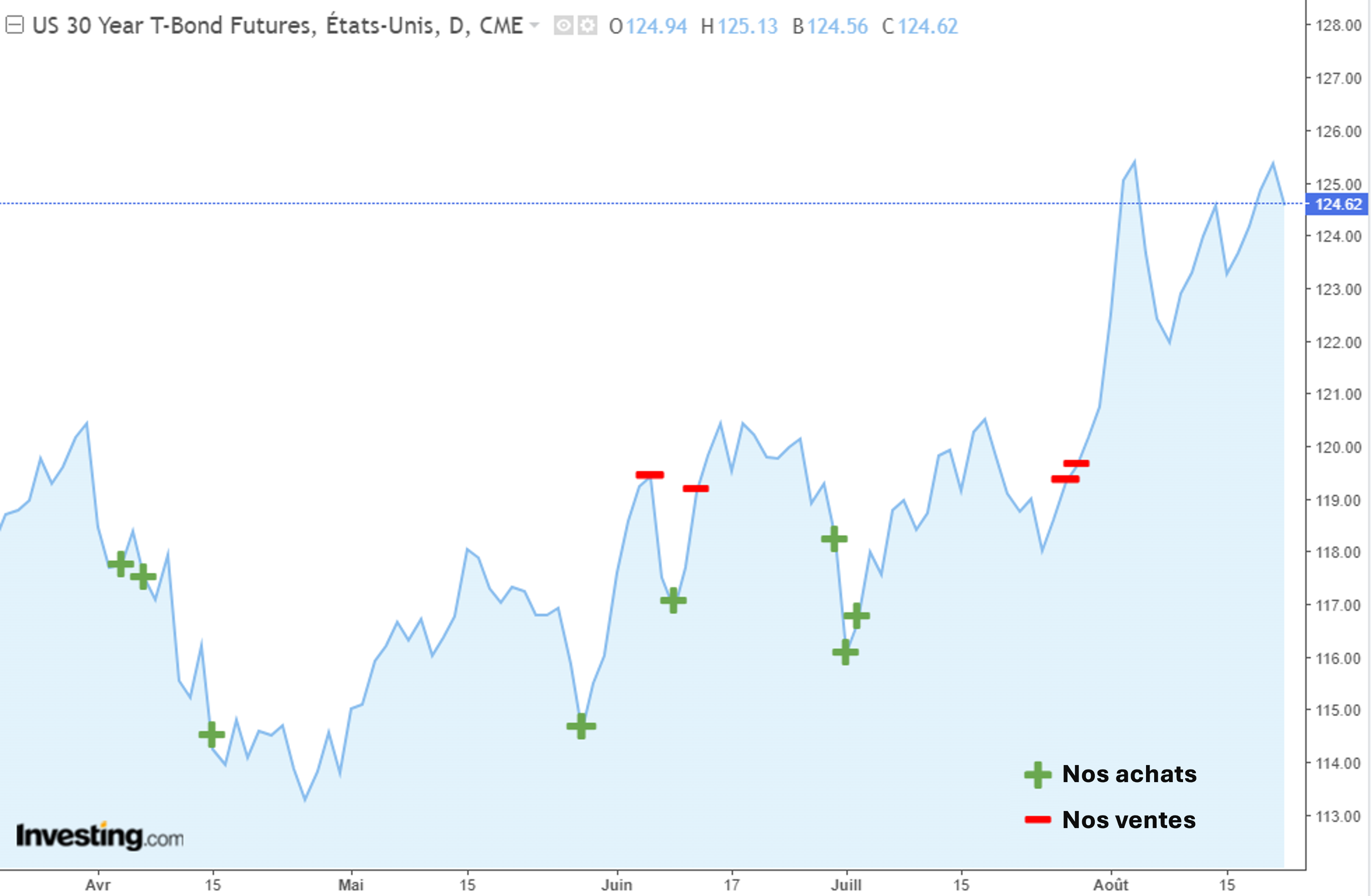

As well as our long position in Treasuries because we were back at 4.15% on the US 10-year, the lowest for 6 months. [We really missed this position during the debacle when rates fell to 3.80%. That said, it's because we were disciplined on this position that so far all our transactions on this instrument have been winners in 2024].

Futures US 30Y

We talked about all these companies in the Billet recently, with the exception of Galapagos. And Galapagos has fallen by 40% since the start of the year, so we need to shed some light on this.

Galapagos has no debt and €3.4bn cash on its balance sheet at 30 June. There are 66 million shares. So the cash value per share is €52. On my screen today, Galapagos is trading at €23 per share, or €1.5bn market cap. The company spends €340 million a year developing its drug projects. So in order to make sense of the market's vision, you have to agree with him that Galapagos will burn through €2bn of cash in six years, without generating any added value. It's possible - anything is possible - but the probability seems low. Paul Stoffels, the boss of Galapagos, is the former Chief Scientific Officer of Johnson & Johnson. He was recently one of the main speakers at the event organised by Roche Belgium to celebrate 100 years of Roche. I don't think what he's going to do with that cash is worth anything.

On the other hand, he could probably take one or two communication courses, as many European bosses should. If I Google the name of the CEO of one of our Nasdaq lines, I get 5 times as many hits as Paul Stoffels. Someone like Max Levchin, the CEO of Affirm, publishes a post on Linkedin every three days. Paul Stoffels does it every two months. That's also part of the CEO's role.

We're keeping our Galapagos.

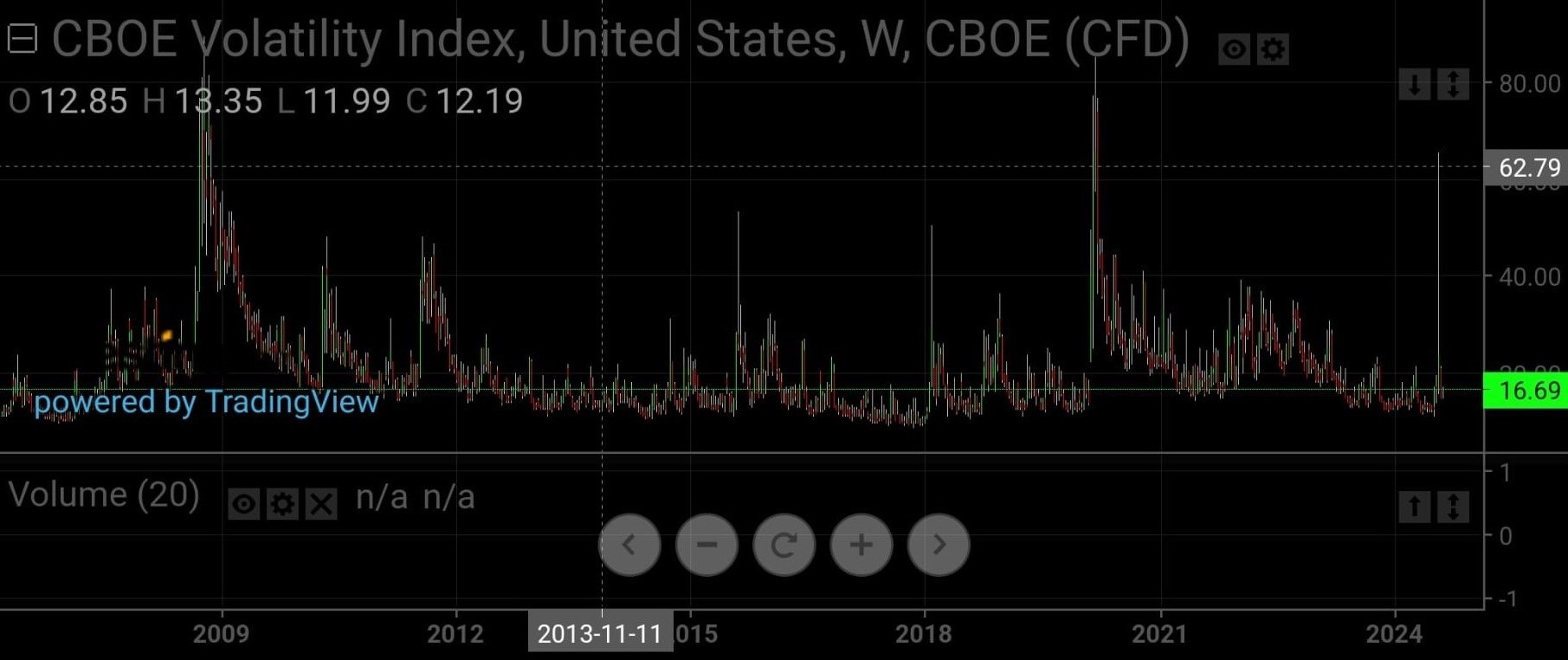

To return to the question of global allocation, I still believe in the thesis of the last week's Billet : the events of the last few weeks have sown doubt among operators, leading to a change in the regime. The Nikkei's 12% fall on 5 August was its biggest since 1987. Not insignificant. Volatility - the VIX - returned to its July level at an unprecedented rate - around 16 - after exceeding 65. Not insignificant either.

VIX

In the space of a few days, we have gone from ‘Crisis’ to ‘No panic, everything's fine’. Yet doubt is creeping in a little more each day that we get closer to the July highs. The question is no longer ‘Do I increase my exposure? but ’When do I go out?

As a result, we are taking note of the change in regime and have decided to remain on the sidelines as I don't think this is the time to take risks. On the other hand, if we see an opportunity on a specific stock, we'll go for it, as always.

Have a good week,

Charles

* One plausible explanation is that traders who played the Magnificent 7 upwards were hedging market risk by shorting/shorting the Russell 2000. The rise in the Russell this week would have been due to the unwinding of these operations.

Market and portfolio focus

Portfolio

Over the week from 9 to 16 August, the Monocle gained 0.5%, the CAC 2.5% and the S&P 500 3.9%.

Our lines participated in the market rebound and enabled us to exit the week higher. LVMH (8% of the fund) gained 3.5% and returned 25bps, Affirm (2% of the fund) gained 12% (20bps) and Duolingo (2% of the fund) gained 8% (15bps).

We had reduced our position in Ouster to $11 before their publication. The results for the quarter were not good, with lidar deliveries falling sequentially. The stock is now trading at $8 and we are holding less than one percent of the portfolio.

There has been no change in our equity exposure this week, which remains at 17% net, giving us plenty of room to act when opportunities arise.

The same applies to corporate bonds, where spreads remain tight and interesting opportunities are few and far between. 13% exposure with Foot Locker (5% of the fund at a yield of 7%), Valaris (4% at 7%) and Rivian (3% at 11%).

Itraxx 5Y

Itraxx shows the difference in yield between a high-yield bond and a government bond (Source: Reuters)

AI training of the week

If you answered €20 and €5, you were wrong, but don't panic, this is the case for the majority of people.

The explanation can be found in Daniel Kahneman's book Thinking, fast and slow There are two ways of reacting/thinking: System 1 and System 2. The first is reactive and thoughtless. The second requires more effort and reflection. For System 2 to intervene, your brain must first realise that System 1 has failed.

In our case, the System 1 answer was 20€/5€ and if we didn't take the few seconds necessary to realise that it was wrong, we remained satisfied with this answer, a victim of our own brain.

The correct answer was 22.5€ for the main course and 2.5€ for the half.

We continue this week. You have two wicks, each of which takes an hour to burn out completely. How can you measure 45 minutes using just these two wicks and a lighter?

Have a good week,

Antoine

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu