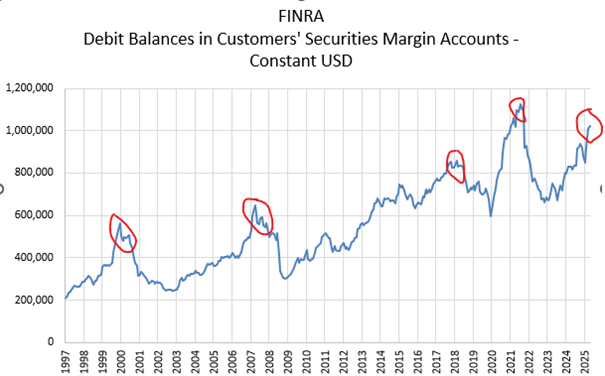

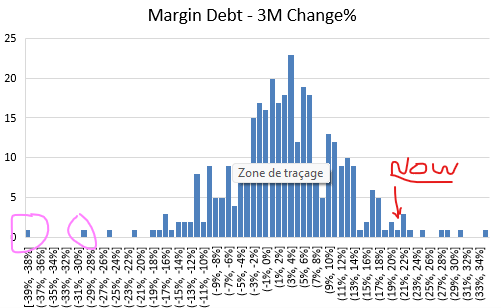

« What about this one ? »

17 September 2025

|

|

|

| Positions

Au 3 Septembre, Monocle (part A) est à +4.02% sur 2025 et à +3.89% en annualisé sur 5 ans. 2024: +1.14% 2023: +7.67% 2022: -1.92% 2021: +4.23% 2020: +6.44%

Le fonds retourne vers les +4% cette semaine. Il y a Duolingo (1.1% du fonds) qui perd 12% en quelques jours: la responsable marketing est partie chez Doordash et un analyste a sabré ce matin l’objectif de cours de $500 à $300. Je regarde de près: Luis Von Ahn est un bon, il va trouver un moyen de redresser le tir.

Galapagos (4.5% du fonds), sans nouvelles, a glissé de 5% sur la semaine. J’ai un call prévu avec leur responsable investisseur dans les prochains jours, je vous dirai ce qu’il en ressort. Le problème avec Galapagos c’est que leur responsable marketing à eux c’est le mime Marceau.

Dans l’autre sens Affirm (0.6% du fonds) a pris 7% sur la semaine et en reprend 6 ce soir. Très belle boite mais ça devient cher.

L’exposition action du fonds reste autour de 20% et nous avons 8% net en USD. Vu la première partie du billet, on ne va pas rempiler en actions juste maintenant ! |

|

|

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu