"The predictions of Nostraberus"

08 August 2024

"Pinuche is tripping over his grey cells, reveals Le Dodu, "just imagine that this old wreck is making up some crushed words for a competition in which the first prize is a moped!"

Her Majesty patches up her stale cigarette with the white outline of a stamp book, and grumbles:

"- I'm asking you, a moped at his age! Suppose he unhooks the bell, it's double pneumonia for Pépère! Already, when he passes between two yawning men, he has to insulate his clock with Thermogene wadding to avoid pulmonary complications!" *

That's what it was supposed to be like this week in Pornic: a San Antonio in the right hand, a glass of rosé in the left, and every now and then, looking up from Bérurier's adventures to keep an eye on the markets.

Obviously, this scenario was swallowed up by the Nikkei's 13% slide on Monday morning.

Mind you, with historic volatility dropping below 7% at the start of July, something like this was to be feared.

Volatility SP500

Source : Investing.com

The wake-up call was serious enough for the likes of Jeremy Siegel, the ever-optimistic Wharton professor, to call on the FED to immediately cut rates by 75bps and to start again in September. With the SP500 still up +8%, it is unlikely that he will be heard, but this shows that the passive management community has been shaken - Siegel is advising WisdomTree, a major player in the sector.

As for the reasons for the movement, the catalyst - a rate rise by the Bank of Japan, US figures confirming the recession, geopolitical tensions - is of little importance. Time will tell, but we can already make a few observations:

1/ There's a lot of leverage in the system - Monday's movement on the Nikkei was the biggest for 40 years.

2/ Bitcoin took a monumental beating on Monday. This means that traders who were selling the Nikkei were also selling Bitcoin. So it is not a safe haven but a speculative asset. No problem with that, just make sure you put the right labels on the right jars.

3/ The market rallied yesterday, but the risk episode will give operators pause for thought. Risk management departments will be re-running their models, and the new results will no doubt point to a reduction in the size of the market. If the conclusion is the same everywhere, the next few weeks will continue to see high volatility..

4/ One of the forces contributing to the reduced volatility noted at the start of this email was the rise of 0DTE or 'Zero-Day-To-Expiration' options. These new instruments proved totally dysfunctional, with market-makers refusing to quote prices on these products on Monday. This will undoubtedly have repercussions, with limits on the use of these products and greater volatility.

In the end, this coup-de-calendar shows that the market is far from being the well-oiled machine that some people were selling it to be. Unfortunately, it comes at a time when the "soft landing" scenario is taking a beating and the "rescue by Mag7s and AI" scenario is taking a beating - we have just learned that Buffett has just sold half of his line in Apple at the end of June.

As Frédéric Dard titled his fifth opus: "Du mouron à se faire" ("A lot to worry about").

Market and portfolio focus

Portfolio

Over the week from 26 July to 2 August, the fund lost -1.5%, while the CAC40 lost -3.5% and the S&P 500 -2.1%.

All our equity lines were in the red this week. LVMH, the fund's largest holding, was the main detractor this week, down 40bps.

Our position in US long rates and our S&P 500 short (via options) partially offset our equity exposure, each yielding 10bps.

As for the results, Tidewater published them last night. Dayrates continue to break records and the cycle to unfold. However, guidance has been tightened, a subject we will be watching closely at this afternoon's conference call.

We can expect to see a number of other publications from our companies this week, including Duolingo (2% of the fund). Beware, in this type of market a publication with a hair out of place can lead to severe corrections, so it's best to be prepared. Luis von Ahn, the founder, is very good at Duolingo's business and AI, so it's a good long-term bet. Now, it could lose an arm tomorrow because the market didn't like this or that figure. Something to bear in mind.

Our lines

Steinhardt method act 2 this week. We cut MARR and took advantage of Lamb Weston's rebound to sell off our position.

At the same time, we replaced part of our Lululemon line with Nike, with 2% on each line.

Two changes have been made to our put options. First, we put a ladle back on Costco. Secondly, we took advantage of the rise in volatility to sell S&P 500 puts: we got a 400-point put spread for free.

We end the week with a gross equity exposure of 27% and a net exposure of 23%.

« Creusez vos méninges »

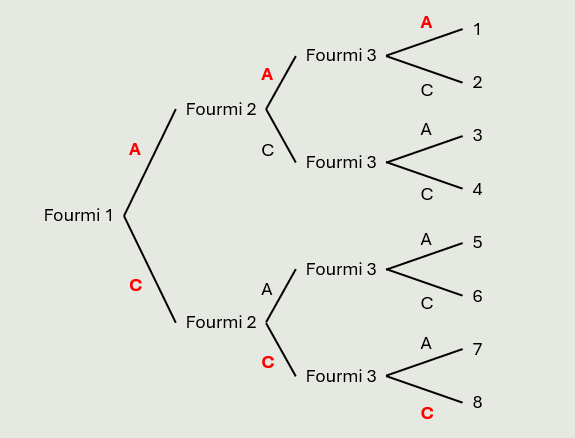

Solution to the ant (fourmis) game: two ways to solve it.

The "Bérurier" method involves making all possible scenarios: with three ants each having two choices, we have 8 possible configurations. If A is anticlockwise and C is clockwise, the configurations are AAA, AAC, ACA, ACC, CAA, CAC, CCA & CCC. Of these 8, only 2 are useful to us. AAA and CCC. 2 out of 8 are equivalent to ¼ or 0.25, or 25%.

The "San Antonio" method is to make a tree. I start with ant 1 (fourmi 1), which can go either clockwise (A) or anti-clockwise (C). I draw the two possibilities for this ant. At each end, I draw the possibilities for the next ant. In the end, only the scenarios where the ants go in the same direction - AAA and CCC - work, either 2 out of 8 or 25%.

Note that this tree model - here basic - is useful for valuing options and structured products because it allows you to visualise what is happening and calculate the probabilities of events - we'll talk more about this in our seminar on structured products, which has been postponed because of the hassle...

* Les Prédictions de Nostrabérus, San Antonio n°83

Have a good week,

Charles

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu