End Of the Movie For Netflix

25 January 2022

The stock drops 22% on the announcement of Q4 results.nd trimestre.

"Netflix disappoints in terms of new subscribers, raising doubts about its ability to grow." This is what we could read on Friday, on the front page of Barron's, a weekly newspaper very followed in the financial community in the United States.

And for good reason, the company has attracted half as many new subscribers as the previous year. More worryingly, the streaming giant expects just under 3 million in Q1 2022. That's 4 times less than in Q1 2019, before the pandemic. Yet the company has spent heavily on content production: $18 billion this year.

We follow Netflix very closely. And as you know, we were not very optimistic about the stock. Last October, we hosted a webinar during which we explained in 2 key points why the stock was largely overvalued:

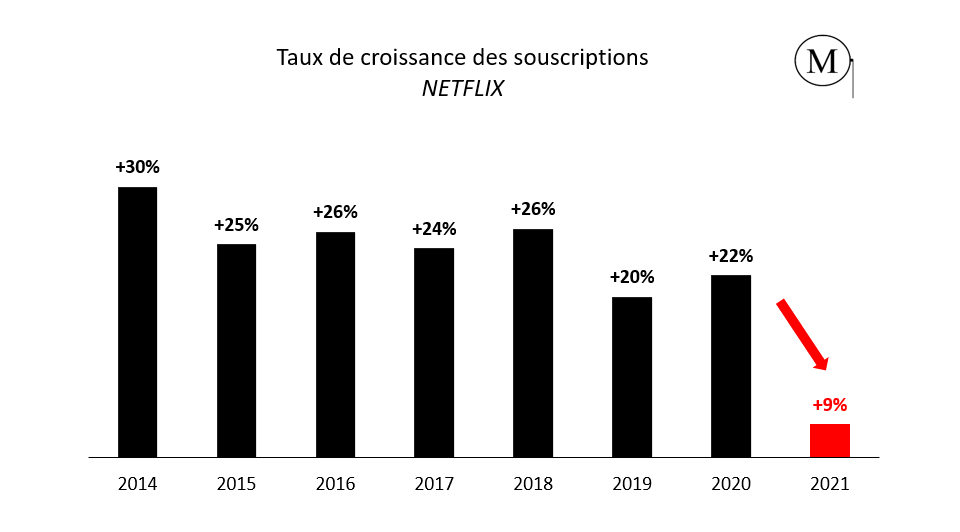

- First point: a coming slowdown of growth in developed countries, i.e. those that are profitable for Netflix.

- Second point: major difficulties in generating margin, as subscriber retention requires massive and ongoing investment in content.

These two points are still relevant, and are materializing: at the end of October, Netflix weighed nearly $300 billion on the stock market. Today, the company is worth $170 billion. A loss of nearly 45% for some investors, which can still get worse.

170 billion dollars is still very expensive for a company that has to invest more than it earns to protect its revenue..

Have a great week,

Pierre

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu