How to beat the high cost of living?

05 April 2022

Let me tell you the story of John, the protagonist of our story, born in the beautiful state of Wisconsin in the United States (more precisely on the edge of the cold waters of Lake Superior) in the course of the 70s.

Our John comes from a modest family: his father was a university professor and his mother a typist. His childhood and teenage years were classic, with the end of the "Trente Glorieuses" cycle.

When he reached his twenties, he was hired as the manager of a furniture store. The economy was doing wonderfully, and our John was happy: he earned a good living and bought his dream car, a 1960 Ford Mustang.

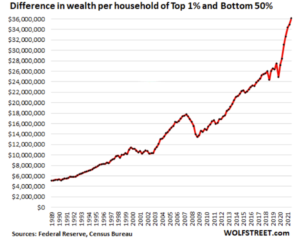

At that time, the wealth gap between John and his neighbor Charlie (to introduce him to you, he is the local notable, this smart guy has succeeded in developing salmon fisheries, a promising business!) This did not bother John, who was satisfied with his lifestyle and saw his purchasing power increase year after year.

However, following the crises of 2000, 2008 and especially 2020, the responses of the central banks had ONE main consequence: an unlimited favoritism for Charlie at the expense of John. Today their wealth gap is $36M.

The situation was getting worse but was still bearable for John, until a new parameter appeared: the explosion of the cost of living with a galloping inflation (direct consequence of the monetary policies of these last years).

Indeed, at the moment, our John is really starting to feel the pinch: he sees Charlie getting richer and richer while he has to tighten his belt more and more to face the increases in the price of his groceries, his rent, and his gas (yes, it consumes a 1960 Mustang!).

There are 165M Johns in the US (and make no mistake, they have their counterparts in Europe).

If there is one thing that is certain in these markets, it is that today the central banks, having played all their cards, no longer have the luxury of enriching a few Charlie's at the expense of all the John's.

And that is not going to please asset prices.

Have a great week,

Max

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu