Summer checkpoint

21 July 2022

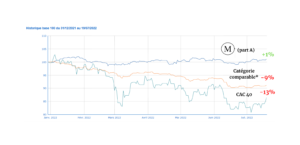

Dear investors, before the avalanche of quarterly results that we'll be talking about for a while, we're taking the opportunity to give you a checkpoint on the fund.As of 19 July 2022, Monocle (A share) is at +1,10% since 1 January.Heritage funds are at -9%* and the CAC40 at -13%. We have been preparing you for the storm for several months. Many indices had pushed us to play defensively with the aim of protecting your assets.

Source : Quantalys

We are now patiently waiting for the lights to turn green so that we can move on to the next phase: making sales. The market correction has brought out some initial opportunities. We have the cash to take them.Our corporate bond portfolio, which has been almost empty for several months, is starting to fill up (9% of the fund). As for equities, we are gradually increasing our exposure. The objective: a net and sustainable performance for the years to come.This transition is being made patiently. Because in our opinion, the worst is still ahead of us...Until then, be careful: it will be a hot summer.The Monocle team wishes you a great week.* Category Allocation Flexible Prudent Europe - Quantalys

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu