Only the Paranoids Survive

02 November 2022

Hello,

META is an important line in the fund (5%). After its publication last week, the stock lost a quarter of its value.

To say straight away what I think: I do not understand this drop.

1/ Turnover is down by 4%, due to the currency effect. It's the same on Youtube (-3%) so the "Facebook is dead" theories don't hold water.

No growth because 2021 was exceptional, customers are more tense in 2022 given the context and Apple has applied restrictions for a year. So nothing abnormal. And even, in detail, good news.

For example, the successful launch of advertising on the group's messaging applications (Messenger and Whatsapp), which are now generating $9bn in revenue per year.

2/ Then you have to separate the two activities: on the one hand, Meta's classic business, which generated an operating profit of $9.3 billion in the quarter. First of all, it must be said that this is a lot of money. To give an order of magnitude, the market currently values Meta at $252bn. This puts it just between Pepsico ($249bn) and Coca ($257bn). This quarter, Pepsico posted an operating profit of $3.4bn. Coke's was $3.1bn. And, incidentally, Pepsico has $34bn of net debt, Coke $30bn. Meta has $30 billion in net cash. If you value this business at Meta as if it were a soda seller, it should be worth about $800bn on its own (Meta makes three times as much money and I'm roughly adjusting for cash).

To give another reference, AWS, Amazon's cloud division, which is supposed to justify the group's $990bn valuation (the other divisions are loss-making), is $5.0bn.

Meta's $9.0bn is therefore a lot of money.

Yes, this result is down by 30% over a year, but the reason is simple: a sharp increase in costs. And no, it's not just Facebook again: Google's operating profit is also down 20% over the period for the same reasons. These companies are investing a lot in their tools at the moment.

3/ And finally, there is the metaverse and the heavy investment in it. This division is generating a loss of $3.6bn this quarter, $9.4bn since the beginning of the year. From what I read (I don't understand it, but I'm trying anyway!) this is what "the market" doesn't like. "The market wants Zuckerberg to just run his advertising platforms and send all the money back to the shareholders. A bit like Apple does. But I don't agree. Because I remember the title of the book by Andy Grove, the founder of Intel: "Only the Paranoids Survive".

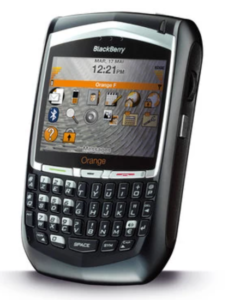

And, to give an example, Meta is investing heavily in neural interfaces. Which allows you to control your device directly with your brain. In this quarter, Meta spent $9.2 billion on R&D. Apple a third less. Not paranoid at Apple. In my opinion, it's the shareholders of Apple, valued this morning at $2.4 Trillion, who should be scared to death of a Zuckerberg in their rear-view mirror who spends 50% more on R&D in one quarter than they do, with the aim of making their only product as archaic as a Blackberry 8700 today in a few years.

(For younger people, the Blackberry 8700 pictured below was the "Best Mobile Phone for Professionals" in 2006).

In conclusion, I'm happy to be a shareholder in a company with excellent financial fundamentals and a paranoid visionary at the helm who follows his plan regardless of opinions and whose interests are directly aligned with mine (he's lost $100bn this year with the decline).

Market and Portfolio Focus

Behaviour:

Over the past week (from 24/10 to 31/10), the fund lost -1.2% of performance while the Nasdaq 100 gave up -0.2%.

This underperformance for the week was mainly due to our position in Meta.

Following the series of Q3 results and the market's rather positive reaction to them despite a less than optimistic outlook, we took the opportunity to reduce the fund's size (net equity exposure is back to 5%) and make some adjustments to the portfolio.

Lines:

On the equity side :

Intel: temporary disposal of the entire line (8%), the stock rose by 10% following the publication of its results last week, which were objectively below our expectations. Even if our long-term thesis on the company is not altered (strategic stake in seedlings for the US), this unjustified rebound reinforces our view that we should be able to buy these same stocks lower in the coming days/weeks.

On the bond side :

Korian 2028: (1.5% of the fund), we have continued to build the position: the company offers an attractive return on debt for a much stronger financial and company profile than Orpea.

Have a great week,

Charles

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu