High Kick

17 November 2022

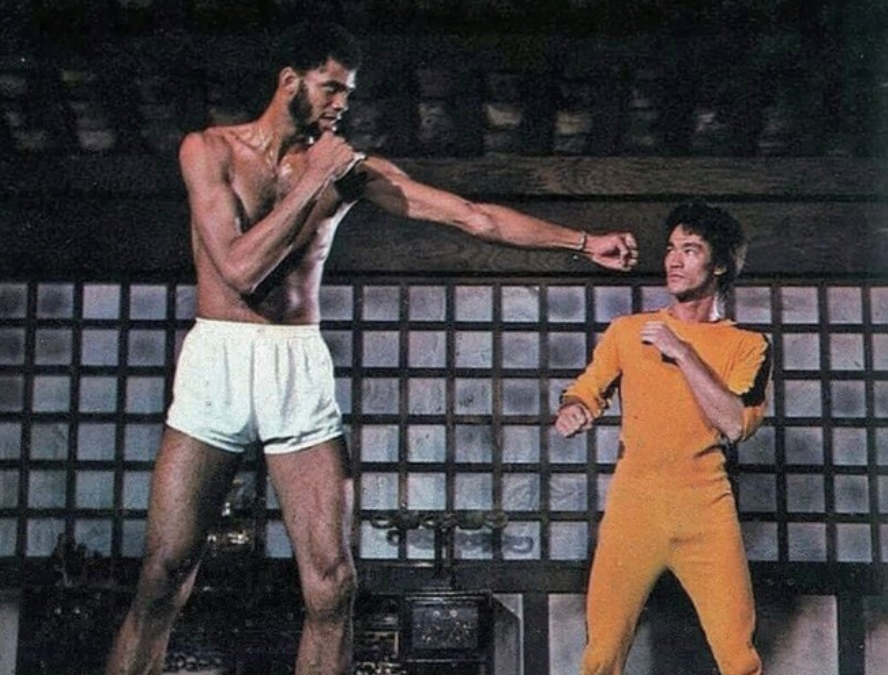

Last Thursday's move on the SP500 (+5.54%), to put it in a nutshell, is like a guy the size of Kareem Abdul-Jabbar walking into the bar you're sitting in to compliment you on your jacket. It's unusual.

Kareem Abdul-Jabbar, it's him (left, right is Bruce Lee).

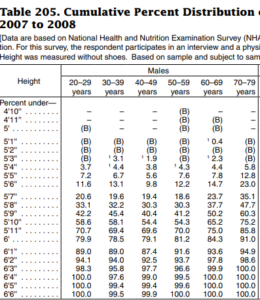

Chez Monocle on aime les choses précises donc voilà la distribution des tailles aux US (source: US Census).

Et comme Kareem mesure 7’2 (2m18) et que la table s’arrête à 6’6 (1m98), il appartient donc aux 0.5% les plus grands. Rare.

The same goes for Thursday's movement: since 1950, in just under 19,000 market sessions, there have only been 24 rises above 5%. Rare.

No such day in the 1950s and 1960s, only one day in the whole of the 1970s, which was nevertheless terribly turbulent. Thursday is a day quite... unusual*.

And sure enough, when your jacket says "SHORT NASDAQ" on the back, after Thursday's move, your shirt looks a bit like Bruce Lee's after he met Kareem:

So it's time to focus if you want to make it through like Bruce.

So I spent some time looking at how the markets had behaved after such sessions. In doing this, I found an interesting day for our current case: 3 January 2001.

The context must remind you of something: after several years of euphoria in equities, the year 2000 is beginning to show serious cracks in the face of a central bank that is already raising rates to calm things down. The first session of the year (2 January, the day before) saw the SP500 index fall by almost 3%. The next day, 3 January, Alan Greenspan did not speak, he acted: a surprise rate cut of 50 bp.

As a reminder, last Thursday's move is explained as a reaction to a weaker than expected inflation figure which could lead the FED to slow down its rate hikes.

In comparison, on the january 3rd 2001, there was a surprise announcement of a rate cut: a stronger signal.

The market reacts violently to the rise. Perfect.

Sauf que ça ne dure pas. L’économie est entrée en récession, les sociétés qui ont connu un afflux de commandes avant le bug de l’an 2000 se mettent à ralentir (CISCO), les guidances sont revues à la baisse.

All this is incompatible with valuations that are still too high at the beginning of 2001.

The market will bottom out 21 months later and 40% lower, i.e. when the purge of the 2000 bubble is over.

I remember that between a deflating bubble and a central bank trying to do damage control, it's the former that wins. So I keep my "SHORT NASDAQ" jacket on.

Have a good week,

Charles

* For those interested, there are 2 such days in the 80's, 2 in the 90's, 12 (!) in the 2000's, only 1 in the 2010's and we are already at 6 in the 2020's.

Yesterday, Wednesday 16 November, Charles was live on the set of BFM Business.

To see the replay it is here : Lien

Market and portfolio focus

Behaviour:

Over the week (from 8/11 to 15/11), the fund gained 0.3% while the Nasdaq recovered 7% (largely due to the extraordinary gains of last Thursday and Friday). Our overall positioning remains cautious with a net equity exposure of 11% and our hedges still in place. The year is not over.

Lines:

BIONTECH (2% of the fund): We are reducing the line to 2% following our successful bet last week. We had raised the position to 4% of the fund following the announcement by the Scholz government that the CEO of Biontech would join the delegation of German business leaders going to China (increasing the probability that Xi would decide to make a deal with the company on covid vaccines). As the price reacted positively, we took profits on this portion of the ligne.

GALAPAGOS (2% of the fund): we have tactically increased the position while maintaining our investment thesis: the company has a negative enterprise value (€2.8bn capitalisation vs. €4.4bn net cash), a limited cash burn of €500m by 2022 (about 8 years of reserves at this rate) and a fairly advanced pipeline of products to be launched with high quality management. We are managing the position in an agile manner with a stop loss on the last ticket we put in place (1% of the fund) - on which we believe the downside risk is limited as the cash level is a good protection for the valuation.

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu