Give me a one-handed Economist

08 December 2022

“Give me a one-handed Economist. All my economists say, ‘on the one hand…’, then ‘but on the other…”

We owe this quote to Mr Harry Truman,33rd president of the United States in office during the atomic bombings of Hiroshima and Nagasaki in 1945. Two other important facts (among many): he supervised the "airborn bridge" over Berlin in the middle of the Cold War and contributed to the creation of NATO. Quite a character.

To return to the part that interests us here, this quote is interesting because it highlights the rambling, unconvincing and sometimes even "artistic" nature of the economist's profession: it is better to keep a fairly neutral opinion for anyone who wants to make a decent career out of it.

Everyone is talking about it enough for me to add my little stone to the edifice: what is driving the world's stock markets at the moment is the very hot topic of inflation. Everyone has their own analysis: have we passed the peak? Is the peak triangular? In short, so many fascinating questions.

Nevertheless, among all these debates, the most exciting one is certainly the one between two of the greatest pundits in the field of economics. I named Paul Krugman Nobel Prize in 2008 and Lawrence Summers (Treasury secretary under Clinton)

The first is (was?) an advocate of the fact that the peak of inflation is far behind us. The second believes that we are far from defeating the beast and that the Fed will have to continue to play spoilsport.

And it is here (on this very line), that all the above gibberish makes sense: a lot of statistics have come out in the last few weeks. Let's do the math:

10/11 : inflation US à +7.7% vs +8% expected, 1-0 Krugman

15/11 : production prices US : +8% vs +8.3% expected, 2-0 Krugman

2/12 : US salary growths : +5.1% vs +4.6% expected, 2-2 Summers

Don't get me wrong, I can count: the latest statistic puts our two protagonists back on an even keel because while inflation seems to be showing signs of weakness (which is consistent with both consumption and production), the robustness of wage growth is THE key point to watch.

Indeed, in economic theory, inflation becomes uncontrollable when it becomes anchored in the minds of agents who begin to ask for wage increases in anticipation of rising prices, generating a self-perpetuating phenomenon (the famous wage-price loop).

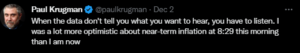

And if we look at this metric precisely, it is accelerating much faster than expected, which could prompt the Fed to maintain austerity for longer than expected. This prompted Paul Krugman to admit last Friday that we were not as out of the woods as he had hoped:

Quoiqu’il en soit, vu les CVs cités plus haut, nous ne faisons surtout pas de plans sur la comète chez Monocle et vous conseillons de maintenir votre vigilance sur « alerte élevée ».

Market and portfolio focus

Behaviour:

Over the week (from 11/29 to 12/6), the fund gave up -1.4% while the Nasdaq did not move. This underperformance over the week is explained mainly by our position in the SAS Airlines perpetual bond (now at 1% of the fund valued at 8 of par) that we have held since 2020 - the company is being restructured and the price movements are not representative of the company's fundamentals in our eyes (mainly due to the very low volume of the stock). For any question on the subject, you can contact : Maximilien Monot (Heal of sales - number : 06 24 80 65 40) or Maxime Neofytos (Sales - number : 06 72 17 18 82).

Lines:

Nasdaq Hedge: we have reduced the hedge position on the equity portfolio to 10% vs. 20% previously - indeed, we believe that at current levels our positions do not require as much protection given their valuations (contained downside).

Have a great week,

Max

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu