Defensive stocks = rubbish

03 April 2024

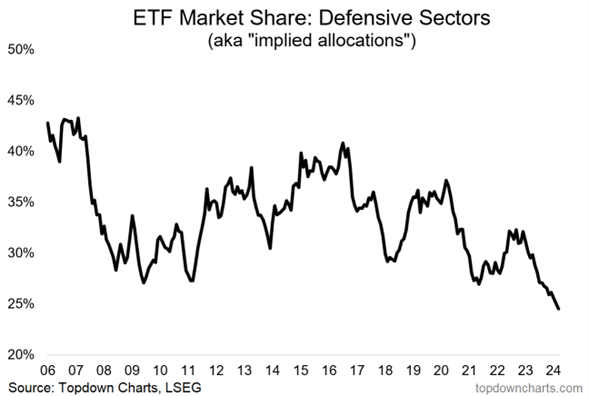

One of the corollaries of the recent tech craze is that other sectors have been abandoned. Allocation to so-called defensive sectors (healthcare, consumer staples, utilities) has fallen to its lowest level in 20 years.

As these sectors are neglected, we are finding opportunities in them. We initiated two lines last week: Unilever and Sanofi. Both are trading at historically low valuations.

On the other hand, we have this graphic that we published last week on LinkedIn :

Spread US High vs Low Momentum

The performance gap between high and low momentum stocks is at a record high. Investors are buying more of what has already risen. So much for the rest. In short, as long as there's music, there's dancing. And the music is loud. Reddit took advantage of this to launch its IPO: IPO at $34, closing at $50 on the first day. +50%, good timing.

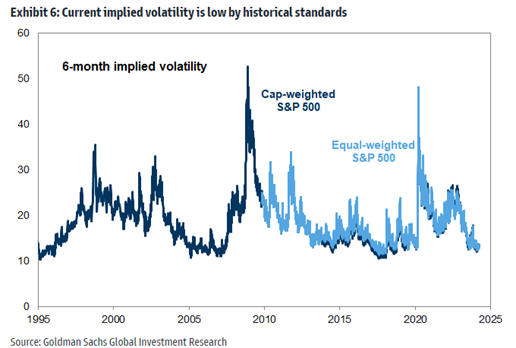

This market schism is accompanied by another signal of complacency: rock-bottom volatility. In practical terms, this means that the cost of insurance is at an all-time low because nobody wants it (we wrote about this a few weeks ago).

But what do we actually do with all this? First of all, don't play the Cassandra and say that everything is inevitably going to collapse. Secondly, keep in mind Howard Marks' adage: "You can't predict, you can prepare". The accumulation of clouds is more a sign of storms than of good weather. For our part, we're staying alert.

Market and portfolio focus

Behaviour:

From 15/03 to 28/03, the fund gained 1.0%, while the CAC 40 gained 0.5% and the S&P 500 2.7%. The main contributors were Alphabet (+0.6%) and Tidewater (+0.3%).

Lines:

During the period, we took a position in Sanofi (4% of the fund) and modified our exposure to the outsourced customer service sector: we sold half our Teleperformance line to take a position in Concentrix, its US counterpart. Our allocation to the sector therefore remains close to 4%.

Have a good week,

Antoine

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu