An important week

30 January 2023

I'm not going to start this post with a pun or a movie reference (which is not typical of me, as you would agree).

Instead, let's make an observation: today is January 30th, and as I pen these words, here are the performances of various stock markets since the beginning of the year:

CAC 40 : +9%

Eurostoxx 50 : +9%

S&P 500 : +6%

Nasdaq 100 : +11%

Nikkei 225 : +5%

There's no denying it—our ascent is undeniable! For comparison, on the Nasdaq 100 (Source: https://rb.gy/dlkomf), for example, out of 185 months of trading since 2007, only five have seen a performance exceeding +10%—January 2023 is on track to join that list.

And when it comes to bonds, it's more or less the same story: The bond market paints a similar picture: the yields on 10-year US and French bonds have relaxed by approximately thirty basis points since the beginning of the year. In short, as Candide would say, all is well in the best of all possible worlds.

Could this be due to stellar corporate results? The assessment is far from straightforward: some companies are posting online but still announcing significant slowdowns (take, for example, LVMH, where sales growth has been halved to 10% in the fourth quarter). Others, however, have fallen far short of expectations (for example, Intel: which reported a -32% drop in sales and a net loss of $700 million for the last quarter). The outlook is not entirely rosy.

On the macro front, it is true that inflation appears to be subsiding, potentially prompting central banks to exercise greater prudence in their monetary policies (although the markets seem to be widely anticipating the good news on that front). However, all of this seems overly optimistic to justify the current market valuations. The Shiller PE ratio—a cherished metric of ours—continues to hover around 29x, nearly double its long-term average of 17x. To say the markets are "complacent" would be a gross understatement.

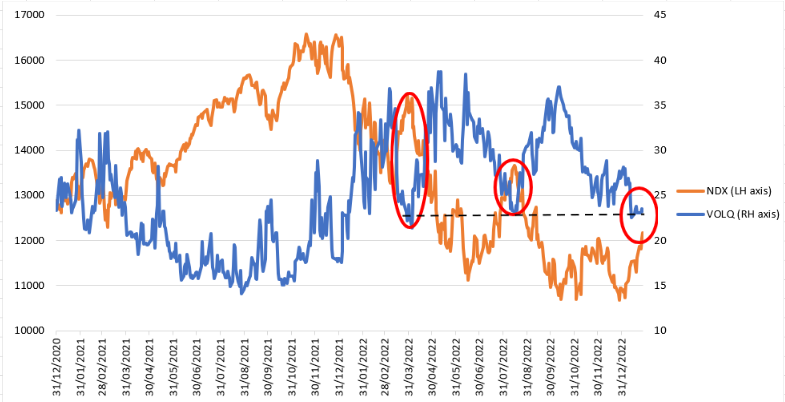

And since I'm in a chatty mood, here's a technical tidbit to underscore these observations. The implied volatility on the Nasdaq (the equivalent of the VIX on the S&P 500—the famous "fear index" that is low when everyone is calm and high when things are falling apart) has returned to its 2022 low: 23. What's surprising is that this level is almost identical to the one reached just before two significant downturns: the beginning of April with a 20% drop and the end of August with a 13% drop. See the red boxes on the graph below (in blue, this volatility indicator, and in orange, the Nasdaq 100 index):

In essence, it becomes apparent that all of this appears a tad too pristine, viewed through the lenses of the market's rose-tinted fuchsia glasses, in our estimation.

As we approach a slew of imminent events, encompassing pivotal decisions by the American and European central banks concerning interest rate hikes, alongside the highly anticipated earnings reports of major global titans (Meta on Wednesday, Alphabet, Apple, and Amazon on Thursday), the current week could potentially herald the resurgence of volatility, simultaneously ushering us back to reality.

PS: Here's one last point that will be the "icing on the cake" when it comes to interest rates—the perception gap between what the markets anticipate (in blue) and what the central bankers have announced (in orange, yes, those are two colors I fancy):

Il semble y avoir encore pas mal de place pour se faire mal.

Market and portfolio focus

Behaviour:

Towards the end of the week (from January 25th to 27th), the fund experienced a 0.3% increase. In the United States, the S&P 500 displayed a 1.3% uptick. The fund's equity exposure remains conservative at 25%.

Lines:

RAS

Have a great week,

Max

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu