Watch out, it's got a kick

17 January 2024

If you're interested in the capital cycle, there's an interesting book to read, Capital Returns by Edward Chancellor. That said, I gave it to Charles, who closed it after ten pages. So I thought it best to give you a summary here.

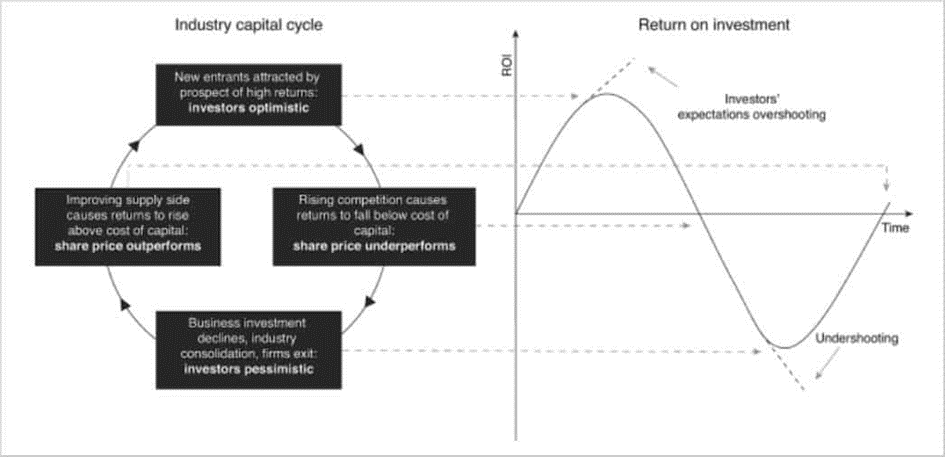

In simple terms, the capital cycle is divided into 4 phases:

1/ Initially, capital is channelled into the industries where it earns the highest returns;

2/ As a result, supply increases and competition intensifies, reducing profits;

3/ Over time, gains become losses, capital is lost, companies go bankrupt, and the industry recomposes itself;

4/ After the chaos comes the good times: the supply side is cleaned up and the players who have survived are raking in the bucks.

The message is simple: if you want to know where an industry is going, understand whether capital is flowing in or out.

En image ça donne ça :

Source: Marathon

Take oil, for example. Between 2014 and 2016, the price of a barrel of oil fell from $100 to $50. The whole sector was affected, especially the offshore industry, which has longer investment cycles. The various subsectors of this industry include drillers and OSVs (Offshore Support Vessels). The former own vessels that are leased for production and exploration drilling. The OSVs own smaller vessels used mainly to supply and moor the drillers. In short, all these companies send specialist vessels out on the water to assist the oil industry.

WTI barrel price. Source Investing.com

In the years leading up to 2014, oil was euphoric after the crisis. China was firing on all cylinders, with prices above $100 a barrel. Exploration was in full swing, and ships could be hired easily and at prices (dayrates) that ensured a very good return on capital*. Seeing these impressive returns, everyone ordered new boats. So after a while there were a lot more boats around the same cake. And in 2016, when the price of oil was halved, there was famine.

Seven years and one pandemic later, where do we stand?

With oil reserves dwindling, investment in exploration has resumed. With fewer boats, the price per day is rising. There's a whiff of dollars again in the industry. Especially since the purge of 2016 saw almost all the companies in the sector go under: you go into Chapter 11 with billions in debt, you come out with millions.

We therefore took two positions in the sector this week. The first was a Valaris 2030 bond, which has the largest fleet of drilling rigs in the world and a solid balance sheet. The signing of new contracts should enable it to generate close to a billion dollars in cash in 2026 and subsequent years, giving us confidence in its ability to repay the $1.1bn debt. At our purchase price, that's an 8% return in USD terms, which isn't bad.

The second is Tidewater, the world leader in the OSV sector with almost 10% of the fleet. Its balance sheet is as white as snow after the purge - debt has been divided by 4. Its average dayrate has risen from $12k in 2022 to $18k in 2023. It will exceed $20k this year, generating $400m in cash. We've taken 2% in shares, and we're keeping a second round of 2% in reserve.

Always keep a spare cartridge: that was a piece of advice from Seth Klarman, but it's also a useful tip from a Quebec bear hunter. Especially if the bear is in a bad mood.

* An anecdote told by an ex-Schlumberger about the atmosphere at the time: he was financial director and saw an invoice for $25,000 arrive on his desk. The job was to repair the TV in the canteen...

Market and portfolio focus

Behaviour:

From 05/01 to 12/01, the fund lost 0.5%, while the S&P 500 gained 1.8% and the CAC 40 0.6%. BioNTech's weaker-than-expected 2024 sales guidance did not go down well (-0.6% contribution), as did the lack of clarity in the Galapagos message (-0.2%). Our insurance via puts on the S&P 500 also cost us this week (-0.2%) following the rise in the index.

Teleperformance held up very well (+0.6%), however, and opinion seems to be changing on the company after it spent 2023 in the doldrums.

Lines:

Quite a few additions to the fund this week. We've already mentioned Valaris and Tidewater above. We also returned to LVMH, twice, taking advantage of the fall triggered by Burberry's profit warning. Lastly, we took puts on the S&P 500 maturing in June 2024.

At 15/01, our gross equity exposure was 46%.

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu