« Poster Boy »

01 February 2024

Last year, there weren't many IPOs in the Cloud.

In fact there was only one: KLAVIYO

After the 2022 debacle* in the sector, there weren't many amateurs left to attempt the exercise.

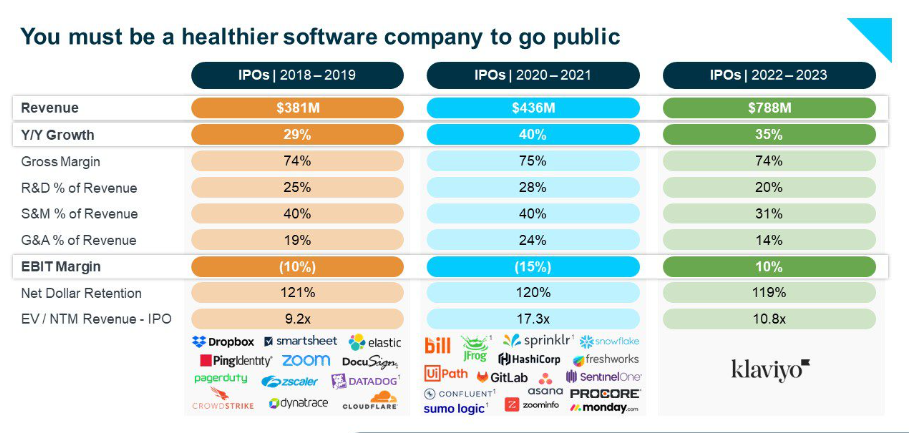

So, as you can see from the image above, taken from the blog of Battery Ventures - Tech's big private equity fund - only the world champions could risk it. And that was the case with Klaviyo.

In this sector, which was emerging from record years in terms of valuation, the watchword was ‘The Rule of 40’. The concept is as follows: the sum of your growth and your margin must be 40% or more. So if you're growing at 10%, you need to show a 30% margin. If you're growing at 40%, you can have no margin at all.

When we look at the details, as given here by Bessemer, another large Tech private equity fund, there is a fair amount of flexibility in the calculations. The margin is the Free Cash Flow - as for these companies a large part of the costs are stock options given to employees, this has a slight advantage in the calculations.

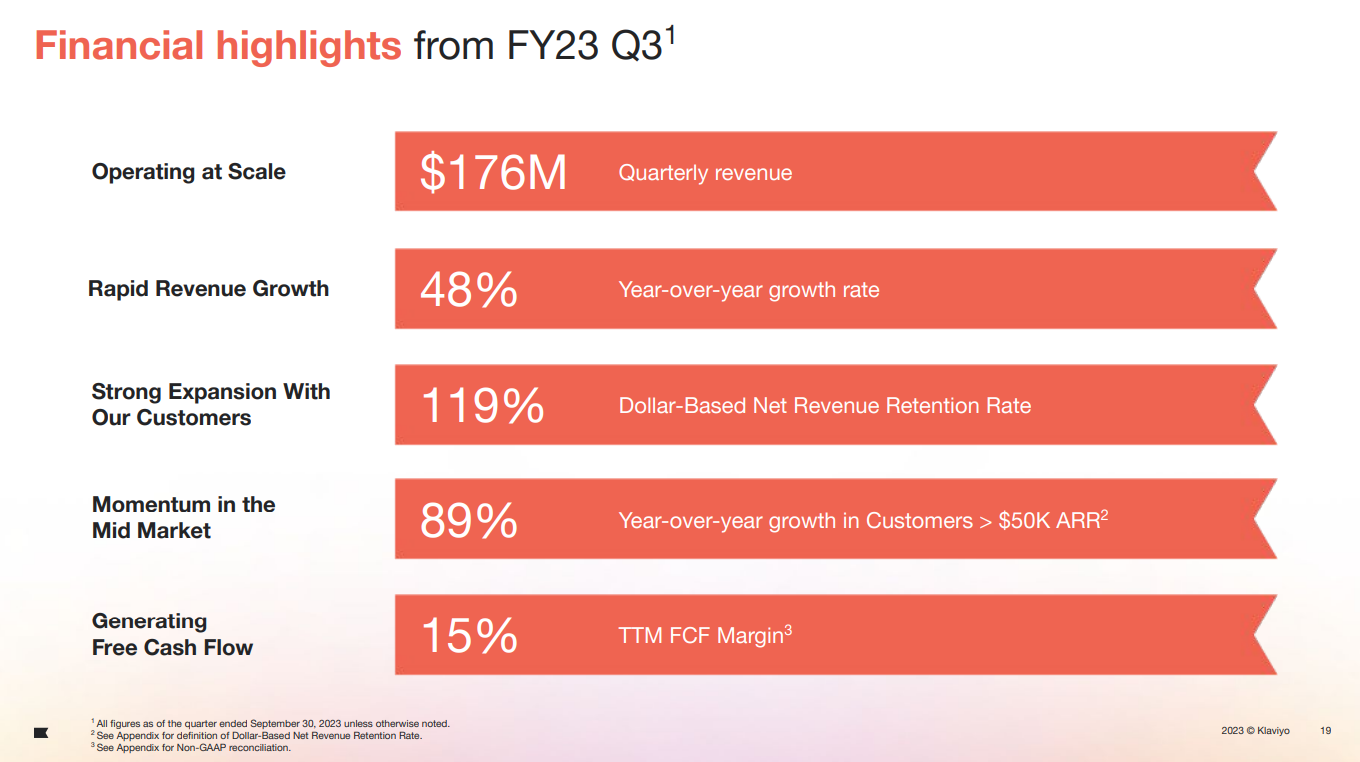

But in short, based on these metrics, Klaviyo was THE POSTER BOY: strong growth, high margin. So we floated at $30 on 19 September 2023. Four months later, we're at $25.90, so I think there might be an opportunity. I look at the results for the previous quarters: growth of over 50% and, in the last quarter, an 89% increase in customers representing over $50,000 in annual sales and still positive margins: the Apollo rocket. OK, the valuation isn't cheap - 9 times last quarter's annualised recurring revenue - but for this sector it's not expensive, say the likes of Bessemer, Battery etc...

I dug deeper. As I dug deeper, I learned that a few months before the IPO, Klaviyo raised its prices by 30%. The monthly subscription fee went from $3500 to $4550, and all its customers went above $50,000 a year, hence the 89% increase in the number of customers announced above.

Being able to increase prices in this way without customers leaving in droves is a good thing, but it's not repeatable. Without a price increase, this company is not growing at all at 50% a year.

This is the slide from the presentation of the Q3 results in November:

No mention of the price increase. It will therefore be difficult to trust management in its financial communication going forward.

When Klaviyo presented its results on 7 November, it announced a growth forecast of +34% for Q4. The market reacted immediately: -18% in two days, as it was expecting the +50% it had been sold at the time of the IPO three months earlier.

Klaviyo publishes next week (6 February). We'll see. In the meantime, she's not getting into the background.

And if this was the Poster Boy of the sector - the only company capable of entering the market after the 2022 downturn - it doesn't reassure us about the rest.

* stampede: on the 1st graph above, in the small centre, you can see all the cloud IPOs for 2020-21. I looked at the performance:

Bill +100%

JFrog: -50%

UiPath: -70%

Confluent: -50%

Sumo Logic -50%

Sprinklr: -40%

HashiCorp: -75%

Gitlab: -40%

Asana: -33%

ZoomInfo: -60%

Freshworks: -50%

SentinelOne: -40%

Procore: -20%

Monday: +11%

So if you put $100 in all those boxes - those space rockets as they were called back then - you're at 33% off today. Not too good.

Market and portfolio focus

Behaviour:

From 19/01 to 26/01, the fund gained 2.4%, while the S&P 500 gained 1.1% and the CAC 40 3.6%. At the end of last week, the fund benefited from our large position (9% of the fund) in LVMH (1.5% contribution). We have since halved our position: at €660 it was a bargain, at €770 it's OK, and above €850 it's starting to look like a lure.

The rest of the performance came from 2 other equity positions: Teleperformance and Tidewater (both contributing 0.3%). Sentiment is changing on these stocks and we are eagerly awaiting their results.

Lines:

Only one operation on the fund this week: the reduction of our LVMH line after the results. We are now below 5%.

En parallèle, on a plusieurs investissements dans le viseur. On devrait rapidement passer à l’action dessus.

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu