The volumes are wrong!

21 March 2024

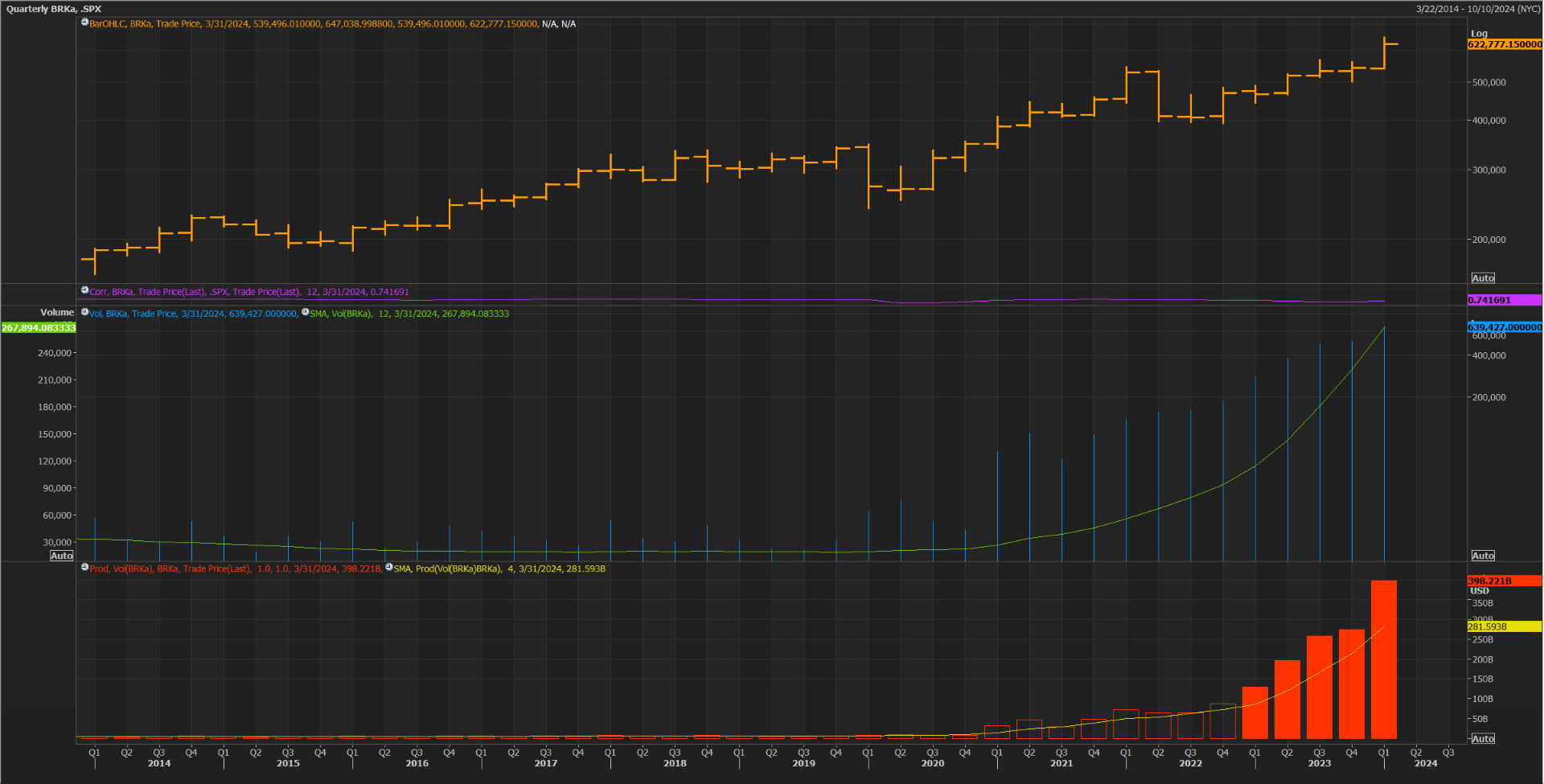

Below is a chart of Berkshire's A-share - the world's largest share at $600,000 a piece.

Volume figures in blue. In red, the volume multiplied by the price, i.e. the $ value of the flow, per quarter.

BERKSHIRE A SHARES

Source : Reuters

$5bn per quarter in 2019, then $50bn in 2021, then $500bn now... Where's the mistake?

The mistake lies in this rule issued by FINRA, the US market regulator, on fractional share trading:

FINRA – Market Transparency Reporting – Article 101.14

"When reporting a transaction involving a fractional number of shares, traders must delete the fraction and report the whole number, unless the whole number equals 0 (zero). If the whole number is 0, traders must round it up to 1."

Fractional share trading has been popularised by Robinhood: before you had to buy a round number of shares, now you can buy for a fraction of a share. "You can start as low as $1," says Robinhood on its website.

So this new rule means that if someone buys $1 worth of Berkshire A shares, the trader 'rounds up' to one share, or $600,000. Hence these incredible volumes.

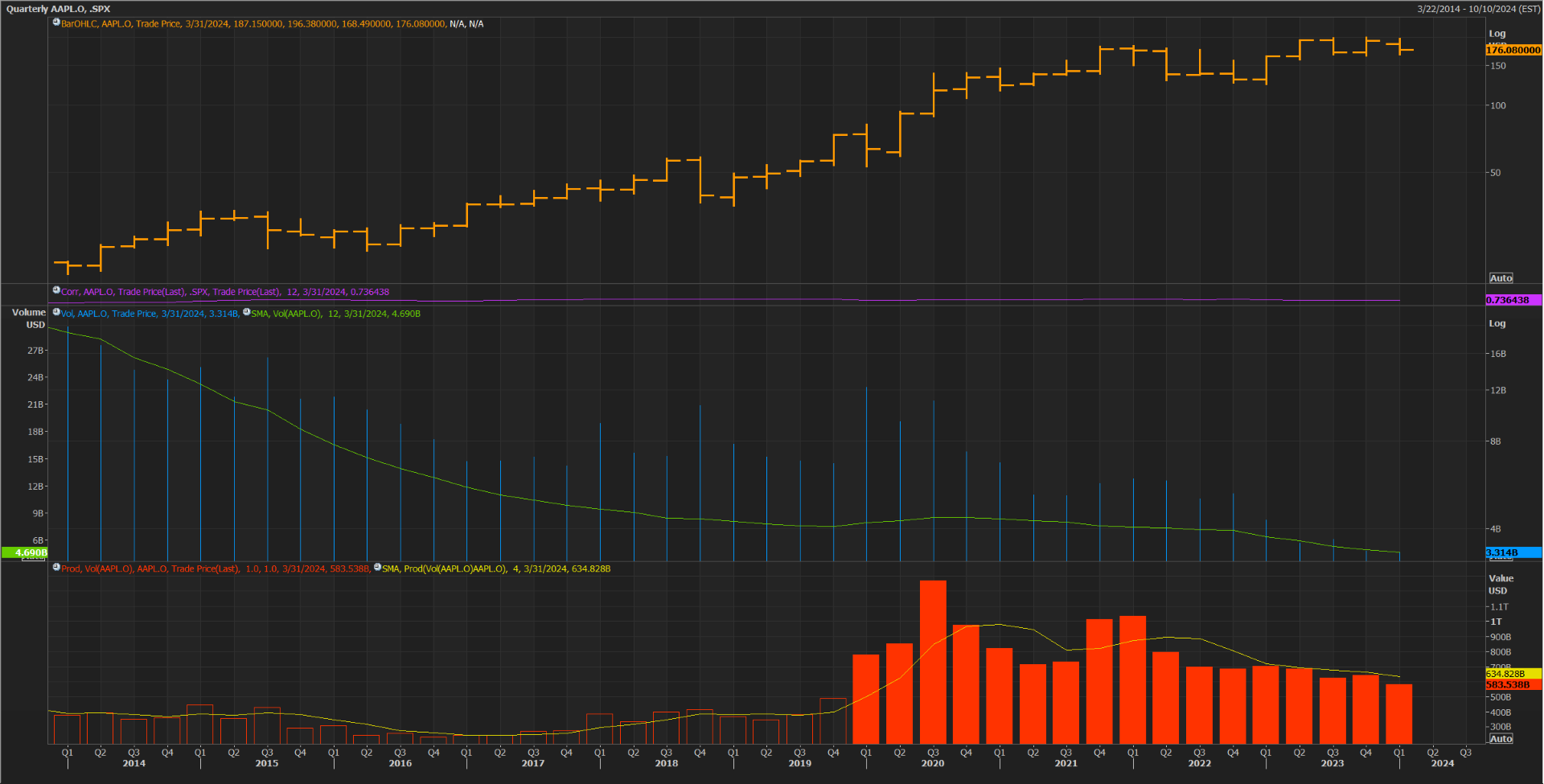

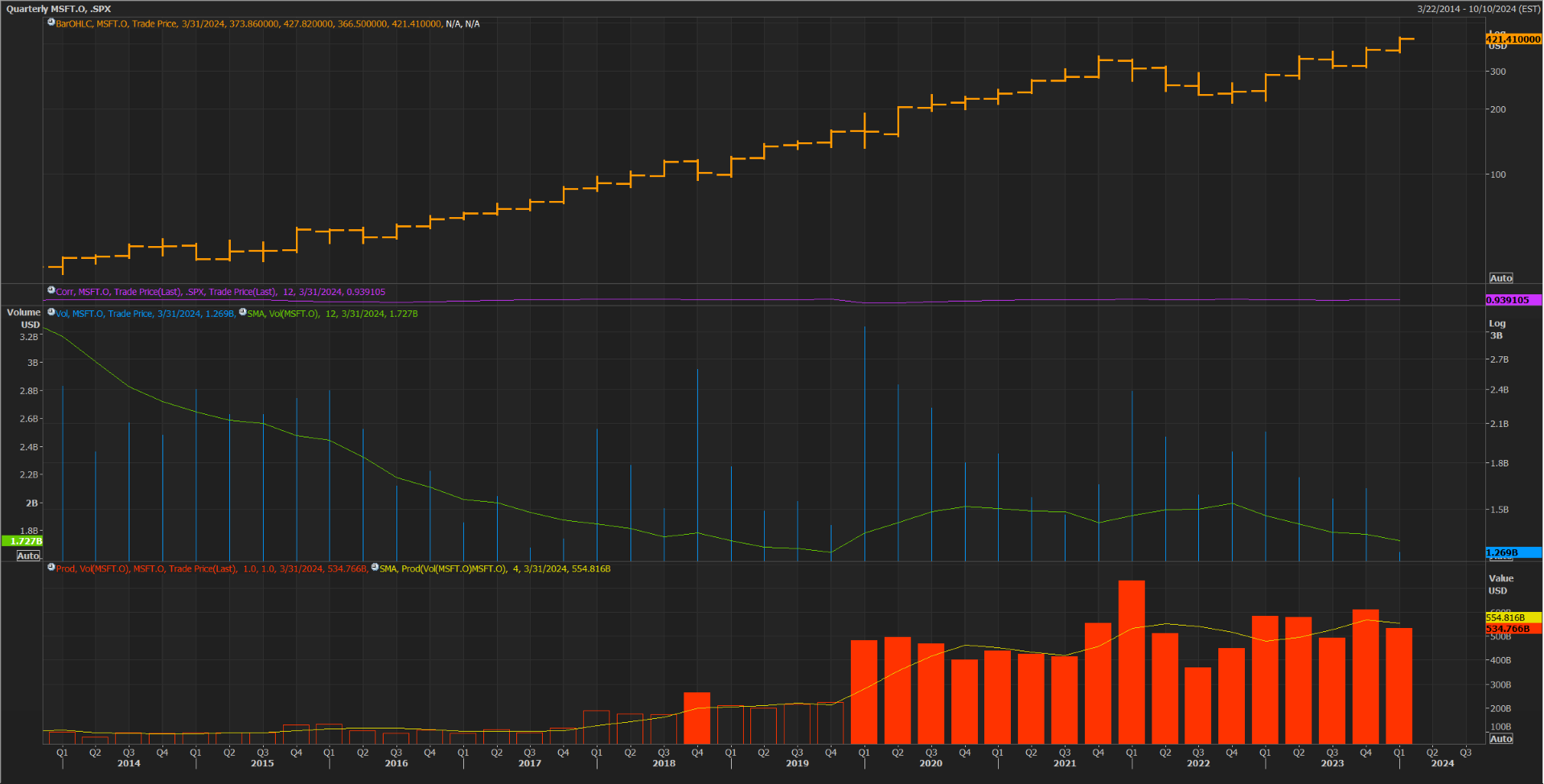

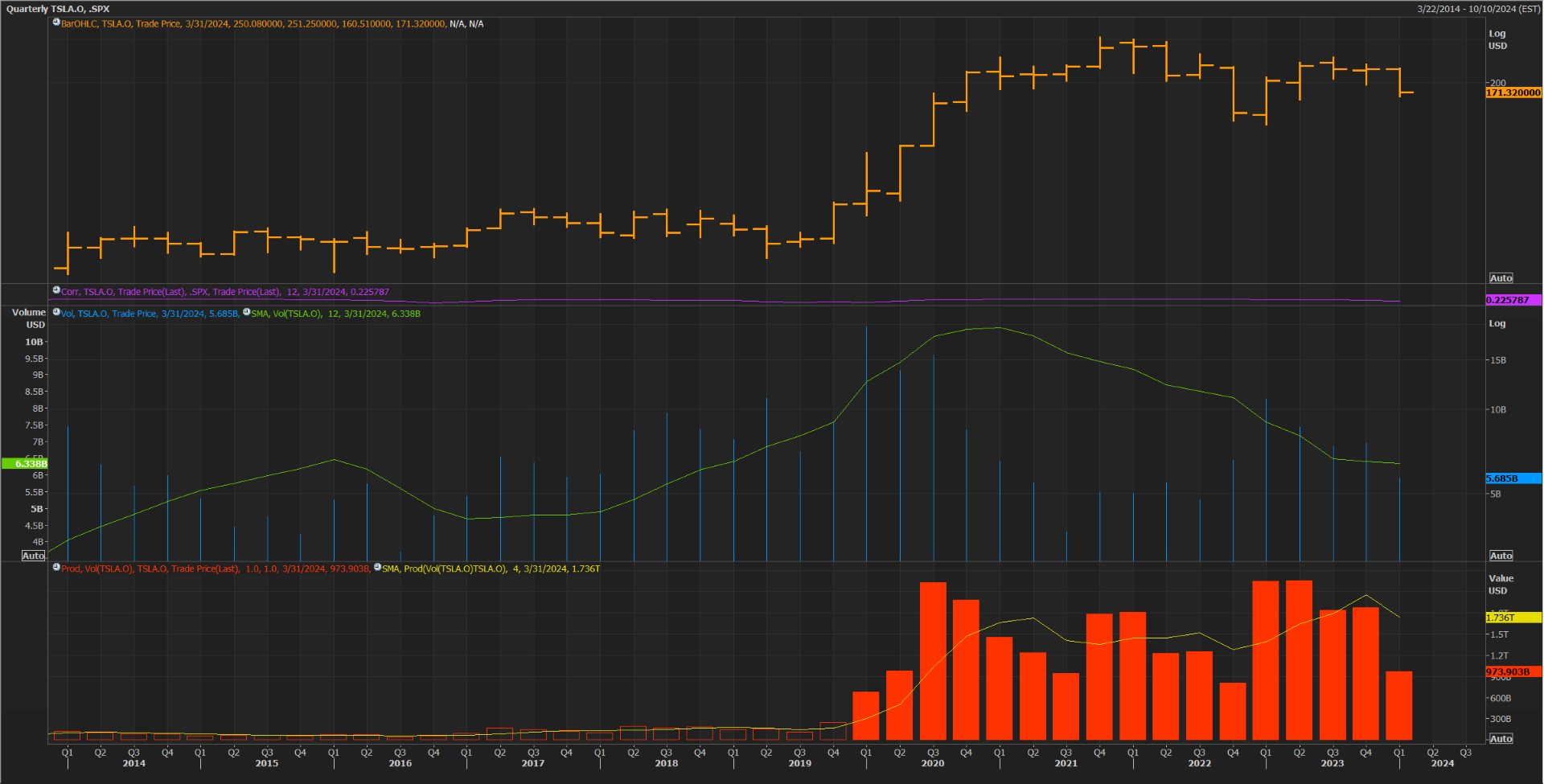

The phenomenon is most visible here, but is also present everywhere. Below are the graphs for APPLE, MICROSOFT and TESLA.

APPLE

Source : Reuters

MICROSOFT

Source : Reuters

TESLA

Source : Reuters

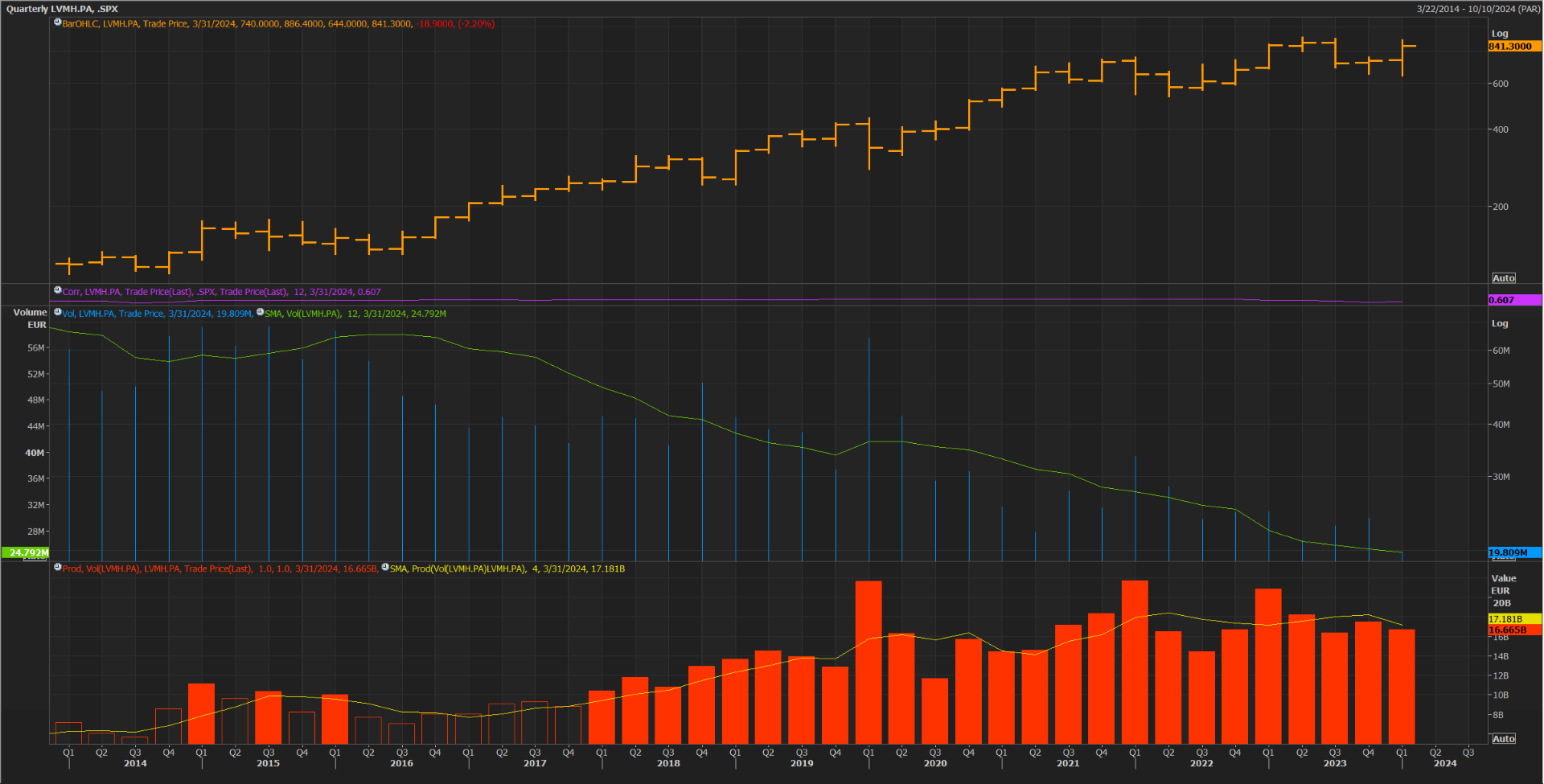

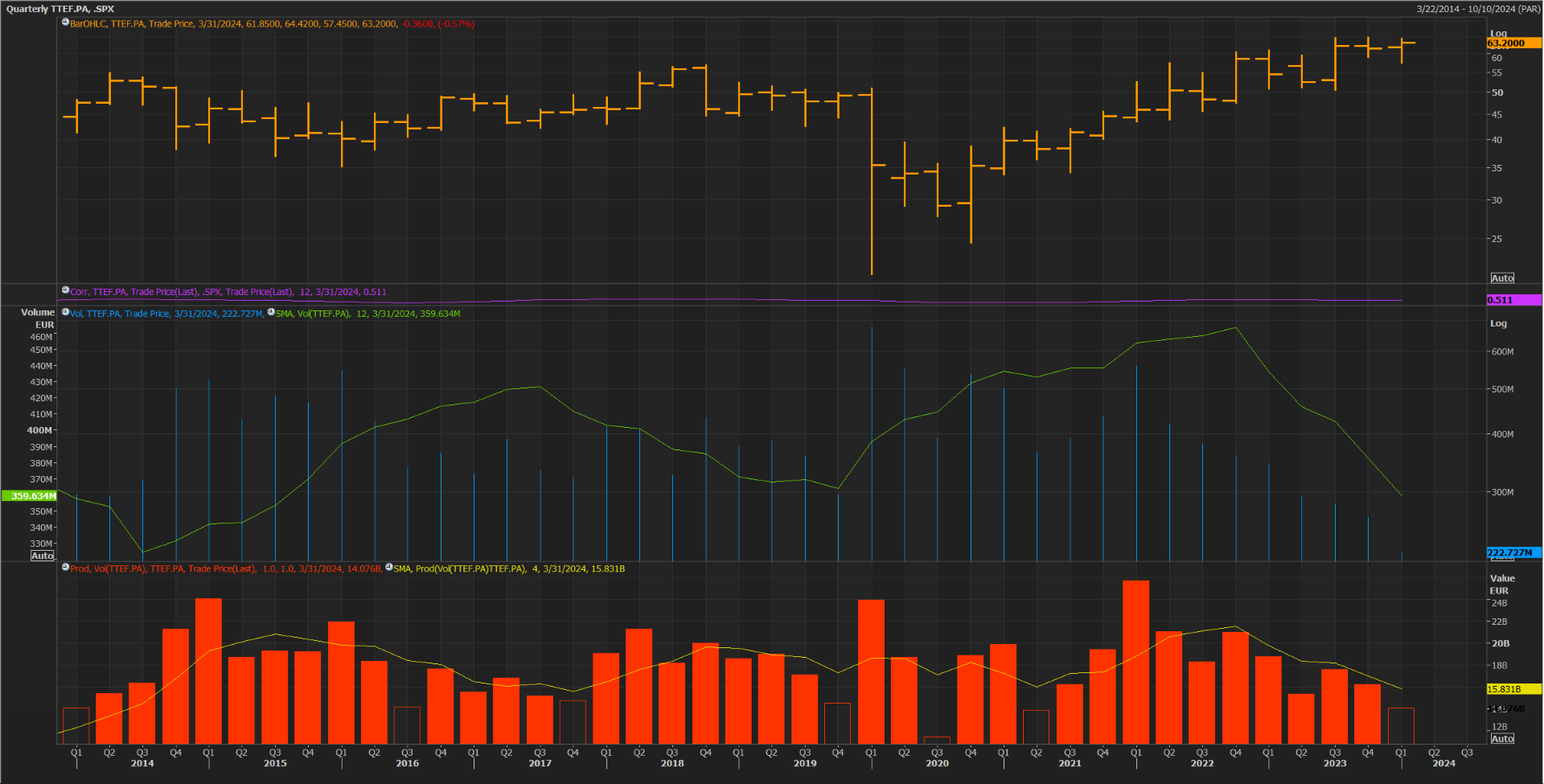

And to compare with a market where there is no fractional trading, the same charts for LVMH and TOTAL.

LVMH

Source : Reuters

TOTAL

Source : Reuters

Conclusion: the volumes that we all follow on US equities are wrong, and the reality is much lower than the figures shown. This means that it is yet another indicator that is disappearing as a means of tracking market trends.

Market and portfolio focus

Behaviour:

From 08/03 to 15/03, the fund gained 1.0%, while the CAC 40 gained 1.7% and the S&P 500 lost 0.1%. The main contributors were Futu Holdings (+0.5%), Tidewater (+0.4%) and Alphabet (+0.3%).

Lines:

This week, we introduced a new line into the portfolio with Unilever (4% of the fund). A good dividend player with a yield of 3.8% on our entry price.

Have a good week,

Charles

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu