A Radiant Future

07 May 2024

No post last week, which was very busy with results publications. But I did find time to reflect on the Macbethian question of our profession: what does the future hold for active investment management?

The stats are indeed pretty tough: less than 10% of managers beat their benchmark index over the long term according to SPIVA's study published each year by S&P. Admittedly, there is a risk of bias on the part of S&P, which makes its money by selling its indices to all passive managers. But Paul Samuelson, winner of the Nobel Prize in Economics, said fifty years ago that since the sum of the work of all asset managers is ultimately only the market, it would be useful for most of them to turn to professions that are more useful to society. You can hear him now here. [It's still great to be able to listen to Samuelson fifty years later]. He mentioned plumbing and teaching Greek as potential alternative occupations. My problem is threefold: 1/ I have no notion of Greek left 2/ my plumbing productivity is close to absolute zero - I love the little drop that falls after two hours of dismantling/reassembling a siphon 3/ I can't resign myself to entrusting my money to the market average.

Robin Wigglesworth, a journalist with the Financial Times, looks at the issue in his book 'TRILLIONS'. It's an interesting book, describing how a handful of individuals - Jack Bogle (Vanguard), Eugène Fama and David Booth (DFA), and Larry Fink (BlackRock) in particular - have developed an industry that, from nothing, has become by far the biggest player on the world's financial markets. Fifty years on, we have come to the stark conclusion:

2 out of every 3 dollars invested in US equities is now managed passively. The book's conclusion is gloomy: Wigglesworth believes that active management will have disappeared within a generation.

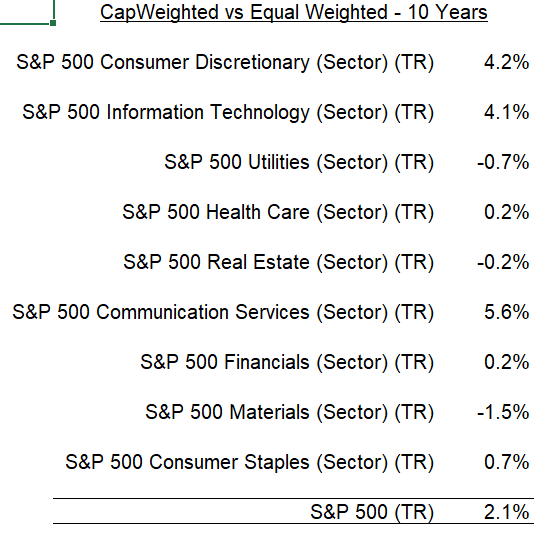

All these advocates of passive management have the same argument: the SP500 is unbeatable. The SP500 is "Cap-Weighted", which means that each line in the index is weighted according to its market capitalisation. According to these same apostles, this is what makes the SP500 so much harder to beat than the Equal Weighted SP500. Because on a fall, your share will lose at worst 100%, while on a rise it may gain 150% or 200% or more. This imbalance means that the SP500 CW - or normal - outperforms the SP500 EW. Over ten years, the outperformance is +2.1% per annum for Cap Weighted.

But with S&P doing things right, they have produced indices for all the sub-sectors of the SP500. In six of these sectors (Financials, Materials, Utilities, Health, Consumer Staples) the difference between the Cap Weighted index and the Equal Weighted index is not significant. There are still three sectors (Information Technology, Consumer Discretionary and Communication Services) where the gap is glaring. These are the sectors with names you know well: Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia and Tesla. So we can draw a different analysis from the outperformance of the SP500 Cap Weighted than the one that says passive management is unbeatable. What was unbeatable over the last ten years was a portfolio made up of these 7 stocks. I won't go into the reasons for the performance of these 7 stocks here. What interests me is to see that it is not the "passive management system" that is unbeatable, but a handful of stocks over a specific, defined period of time. As a result, after reading all these pages, research, studies and stats, my mind is made up: With the help of Mimoza and Antoine, I'm going to continue to choose the stocks, bonds, convertibles and other items that will go into my funds, one by one, by hand. The Magnificent 7 are already less so than last year with two down on 2024, and with the level of multiples on the other five, I don't think the Quinté in 2034 will be made up of the same names.

In any case, if I had listened to Samuelson et al and thrown in the towel, what would I have told Gaston, my grandson who arrived on 21 March, when he asked me in a few years' time "What do you do for a living? It's impossible to make him dream with a story that starts with "I buy an ETF that replicates the XYZ index...". But here, I can tell him stories... "You see the picture on the wall? That's Lina Khan, head of the FTC in 2024, who decided to torpedo our Tapestry-Capri merger. Here, give me a dart...".

Market and portfolio focus

Behaviour:

From 26/04 to 03/05, the fund gained 1.99%, while the CAC 40 lost 1.62% and the S&P 500 gained 0.55%. Our main contributors were Tidewater (+0.4%), BioNTech (+0.3%), Teleprformance (+0.2%) and our positions in US interest rates (+0.4%).

Lines:

Transactions of the week: not much this week. We had taken out some protective positions on the Nasdaq in case the market reacted badly to these releases. It didn't help, but it didn't cost us anything either. And remember that, as insurance, s’il y avait eu un coup de semonce, il y avait des airbags chez Monocle. At the end of the week, we took two small positions (0.5% each) in companies at much higher valuations than we usually do: Duolingo, a language-learning specialist, and Aurora, an expert in autonomous truck driving. These are long-term bets on impressive teams: Luis von Ahn, founder of Duolingois one of the most brilliant people I've heard in a long time, particularly on the subject of AI. And the leaders of Aurora are Chris Urmson, former head of autonomous driving at Google, and Sterling Anderson, who had the same role at Tesla.. That's what I like about this fund and this job: to see lines like these alongside Unilever and Orange in the same portfolio. In terms of exposure, we are close to our regulatory limit of 49% in equities - which forced us to reduce Biontech a little last week. There's still room in credit, but we're waiting for a bit of stress before going back in.

Have a great week,

Charles

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu