You Always Hurt The One You Love

28 May 2024

Librairie Galignani, rue de Rivoli. I saw this 600-page book entitled YOU ALWAYS HURT THE ONE YOU LOVE and wondered what it was doing in the Finance section. It should be next to ‘FIFTY SHADES OF GREY’ in the ‘Erotic Fantasy’ section. But on closer inspection, the subtitle brings us right back to business: ‘CENTRAL BANKS AND THE MURDER OF CAPITALISM’.

It was when I turned the book over that the list of recommendations caught my eye:

Mervin King, former head of the Bank of England :

‘Connolly takes no prisoners. He reveals that the cause of the financial crisis ten years ago was monetary policy itself, due in particular to a flaw in the reasoning of Western economists. Seduced by their own theory, they ended up preferring it to the reality of the world.’

Paul Tudor Jones, gérant de hedge fund – connu pour avoir triplé son argent pendant le krach de 1987 :

‘He's a seer. And what he sees in this new book and explains more clearly than anyone else is how central bank policies based on totally inadequate academic theory have so distorted Western economies that capitalism itself, and the overall structure of our societies are now at risk.’

I buy the book. A few weeks and 600 pages later, what is Connolly's message?

1/ In 2008, Elizabeth II asked the pertinent question: ‘But how come nobody saw this crisis coming?

Connolly's explanation: most economists use a model that is beautiful in theory but disconnected from reality. In particular, their model :

- L'explication de Connolly : la plupart des économistes utilisent un modèle qui est beau en théorie mais déconnecté de la réalité. En particulier, leur modèle :

- b) Si quelque chose semblable à une bulle apparaît, il est impossible de l’identifier avant qu’elle n’éclate.

Lesson for investors: as long as this model is in place, never wait for a central bank to take action to deflate a bubble.

2/ Massive intervention by central banks in 2008 and 2020 was essential, otherwise ‘the liquidation that would have occurred would undoubtedly have produced a Mad Max scenario’.. But outside these moments of extreme crisis, central bankers need to monitor the impact of monetary policy on asset values.

This was the case until 1996, when Greenspan, former chairman of the FED, spoke of Irrational Exuberance. A year later, however, he made a U-turn and created the « Greenspan Put » – qui sera suivi du « Bernanke Put », du « Yellen Put » puis du « Powell Put », c’est à dire The assurance that the central bank will always intervene if asset values fall.

In so doing, he opened the door to a fundamental monetary imbalance, the consequences of which we are now paying. Starting with Greenspan's U-turn in 1997, on est passé dans un système où les marchés financiers – toutes classes d’actifs confondues – génèrent des bulles de plus en plus grosses. And each time the bubble falters under its own weight, the cost of liquidating it would be so high that the authorities have no choice but to immediately inflate a new bubble, even bigger than the previous one.

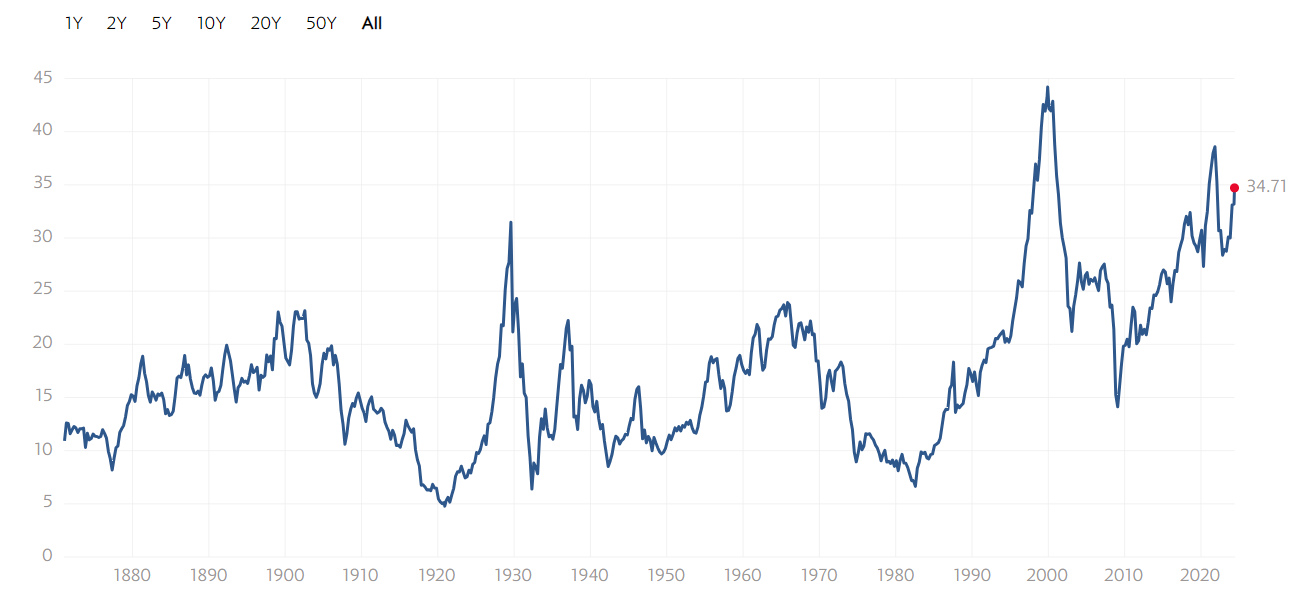

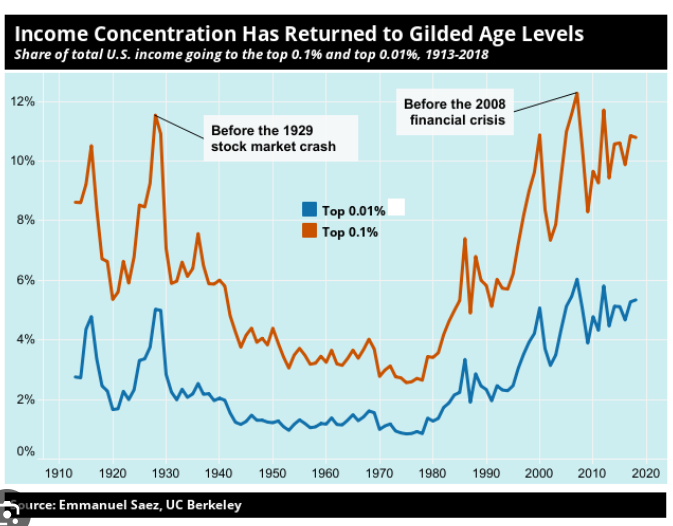

This phenomenon creates ever-higher valuations - it's no coincidence that the Shiller PE is now at its highest, see graph below - and it exacerbates the inequalities between those who have and those who don't. And Connolly is worried about the political repercussions of this situation. And Connolly is worried about the political repercussions of this situation: this system undermines the foundations of capitalism and, by extension, those of democracy.

Shiller EP

Source : multpl.com

3/ In terms of the level of the ‘pilot in the plane’, Connolly gives his ranking:

At the top, Greenspan, who was less academic than his successors but more intuitive, despite his original error on the Greenspan Put. Behind them, Bernanke and Yellen, pure academics but out of touch with reality - although Bernanke had a slight advantage in that, after ignoring the subprime crisis for months, he proved to be effective once the scale of the problem had been grasped.

And Powell is a long way behind. This is illustrated by Powell's answer in April 2021 to a question about a possible rise in inflation before a fall in unemployment:

Powell: ‘I think it very unlikely that inflation will rise before full employment. If that were to happen, there is a doctrine at the FED for deciding when two objectives [i.e. either lowering unemployment or controlling inflation] are contradictory. We then take into account various factors, including how long it would take to go back and so on... It doesn't really say what to do, but it does say that we're going to assess these two factors, how far we are from them and how long it would take to achieve them in case we find ourselves in this rather unlikely state.’

If you don't understand what Powell said, don't worry: neither do we, and neither does Connolly:

‘What this answer taught us - if it taught us anything at all - was that the head of the world's leading central bank had no idea, and could give no indication to the markets, businesses or the public, of how the FED would react in this situation. We could envisage a scenario where she'd fail outright.

And, for the record, we found ourselves in this ‘rather unlikely state’ a few months later.

Keep this in mind before each Powell announcement - the same applies to Lagarde: the current heads of the FED and ECB are at lower levels than their predecessors.

4/ Finally, at the very end of the book, we find this conclusion:

‘These bubbles, whatever the degree of responsibility of investors, were in fact initiated by the central banks, which persuaded the markets for long periods that the systemic risk had disappeared. [...] Of course, there have been situations over the last 25 years - and there will be others in the future - where risk aversion returns and bubbles are temporarily deflated. But these bubbles have had to - and will have to - be reconstituted.’

And the final word, at the end of 578 pages: ‘But if the consequences of this policy of low or even negative interest rates and ever-increasing deficits are horrendous, then we have to face up to them, the alternative of a very deep depression by resetting the system would be worse. »

Conclusion: we should have much lower rates in the future. Now is the time to buy long rates.

Market and portfolio focus

Behaviour:

From 17 to 24 May, the fund lost 0.9%, as did the CAC 40, while the S&P 500 was unchanged. With no specific news, Galapagos cost us 30bps, while Ouster and Pernod Ricard each cost us 20bps. It should be noted that concerns about avian flu in the United States benefited Biontech, which gained 30bps this week.

Lines:

Exit Unilever. We spotted the dividend yield peaking in March and saw that, historically, it corrected very quickly. This is exactly what happened. We took our 50bps contribution in two months and we're now looking for another horse.

In the other direction, we brought in a line from Lululemon (1%). -40% in 2024 for the number 1 in yoga clothing. We hope their shareholders are as flexible as their customers, because the valuation is a big difference: 70x earnings in 2021 compared with 20x today, the lowest since 2014.

Have a great week,

Charles

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu