"This country is at war..."

28 February 2022

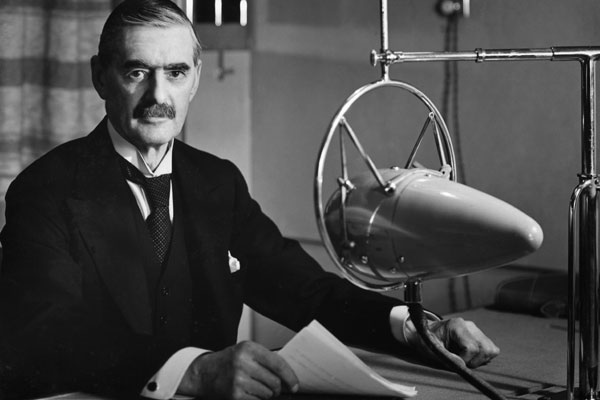

It was in these explicit terms that Neville Chamberlain (British Prime Minister) officially declared war with Germany on September 3, 1939.

The situation at that time is not unlike the current situation with the escalations we all know between Russia and Ukraine. Without going back over the human aspects - dramatic - of the conflict, the idea here is to analyze the economic and financial sanctions put in place and their impact on the financial markets.

[In addition to the various freezes on assets, yachts, private jets and other sports cars of the oligarchs, we are more interested in the withdrawal of the major Russian banks from the SWIFT payment system and the prohibition of intervention on the foreign exchange market by the Russian central bank].

Yesterday evening, customers of some Moscow hotels and restaurants were faced with an unusual situation: a systematic refusal of their credit card payments. This is perhaps the most concrete impact of the measures put in place.

Then, the most immediate and frightening financial consequence is perhaps the extreme volatility of the Russian currency (the ruble). At the opening of the market this morning, it had lost more than 30% of its value against the dollar at the close of last Friday. The impact is even more violent as the main Western central banks have decided to prohibit the Russian central bank from intervening in the foreign exchange market with its reserves*, leaving it helpless in the face of the events.

The last time such an event occurred was on August 17, 1998, when LTCM, the most famous American hedge fund of the time - founded by John Meriwether, an emblematic figure of Wall Street, and Nobel Prize winner Myron Scholes - exploded. The episode resulted in a near systemic crisis, colossal losses for the exposed banks ($700m for UBS, Dresdner Bank $145m...) and the setting up of regulatory safeguards (notably the President's Working Group on Financial Markets) by President Clinton.

The second consequence concerns Russian foreign debt: Russian companies owe nearly $120bn to the banking sector. The foreign portion of this exposure lies mainly with European banks, led by Raiffeisen Bank (one of Austria's largest banks - $200bn in assets and 50,000 employees), whose 35% of pre-tax profit comes from Russia, and closer to us, Societe Generale, whose exposure to Russia amounts to $20bn (nearly 2% of the group's credit risk exposure). Both stocks are down 20% and 12% respectively today.

The million-dollar question: what happens to these positions in a world where Russia is no longer able to process international payments? The intuitive answer: not much. The market is already anticipating that the risk of Russia defaulting on its debt exceeds 50% and things are looking worse and worse as time goes by.

No pun intended: watch out for a roller coaster ride (called "Russian Mountains" in French) in the financial markets, then.

Take care in these dark times,

Max

*To control its exchange rate, a central bank can intervene by buying/selling its currency against foreign currencies.

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu