The Death of Accounting

14 June 2023

In 2016, Baruch Lev published his book "The Death of Accounting". It's a field he knows well: he spent his entire career as a professor of accounting at New York's Stern University.

His initial point is simple:

1/ the accounting principles on which company accounts are based date back more than fifty years. They have therefore not kept pace with changes in corporate life;

2/ the value of today's companies is increasingly based on intangible assets;

3/ these intangible assets are undervalued by conventional accounting methods;

4/ as a result, these companies are posting accounting losses which are not real losses.

In his view, a large proportion of expenses treated as costs (such as R&D) should be treated as capital expenditure, since they contribute to the creation of these intangible assets.

By applying this method, the company's costs are reduced, turning losses into profits.

Baruch Lev points out that most investors do just that. As an anecdote, he cites that the average number of downloads of financial reports from the SEC website is 28 on the day of publication. When a student asked, "Do you mean 28,000?", Baruch Lev replied, "No, 28 people! There are more people working at the FASB* than reading the financial reports!"

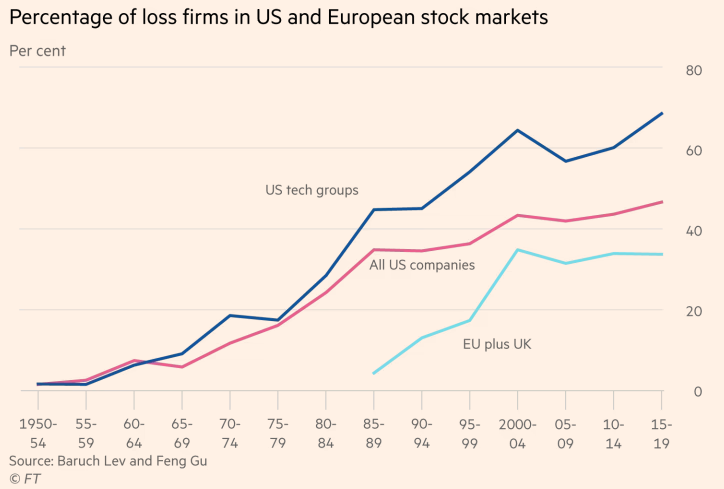

And as an illustration of the phenomenon, it therefore seems normal to him to see more and more companies losing money in international equity markets (graph below published in an opinion by Baruch Lev in the Financial Times in June 2021 - "Don't be fooled by corporate losses").

Of course, Baruch Lev's first example is Amazon. He quotes one of his colleagues who starts his class by asking his students "Would you invest in a company that has made losses for ten years in a row?" The students obviously answer no, only to learn that they'd be millionaires if they'd invested, because he's talking about Amazon.

I understand and agree with his reasoning in principle. But the problem is its application. Accounting rules are, as their name suggests, rules. That doesn't stop some people from twisting them, but there are limits. In contrast, in adjusted results, where there are no rules, management latitude is much wider. Of course, this latitude is used to turn pink rather than black.

Alors qu’est-ce qui nous reste pour faire le tri? Comme dans le film Usual Suspects, j’ai aligné ici les quatre plus grosses capitalisations US:

Apple $2.900 Bn,

Microsoft $2.400 Bn,

Alphabet $1.600 Bn,

Amazon $1.300 Bn.

Now here's the net cash generated, after investment, by these companies over the last 5 years:

Apple $350 Bn,

Microsoft $180 Bn,

Alphabet $190 Bn,

Amazon $0 (zéro) Bn.

Maybe we don't need to reinvent accounting.

*FASB: Federal Accounting Standard Board, American regulator of accounting rules

Disclaimer

This presentation is a promotional document. The content of this document is communicated by and is the property of Monocle Asset Management. Monocle Asset Management is a portfolio management company approved by the Autorité des Marchés Financiers under number GP-20000040 and registered with the ORIAS as an insurance broker under number 10058146. No information contained in this document should be construed as having any contractual value. This document is produced for information purposes only. The prospects mentioned are subject to change and do not constitute a commitment or a guarantee. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. The fund mentioned in this document (Monocle Fund SICAV) is authorized for marketing in France and possibly in other countries where the law permits. Before making any investment, it is advisable to check whether the investor is legally entitled to subscribe to the fund. The risks, costs and recommended investment period of the funds presented are described in the KIDD (key investor information documents) and the prospectus, available free of charge from Monocle Asset Management and on the website. The KIDD must be given to the subscribers before the subscription. Past performances are not a reliable indicator of future performances. Monocle Asset Management cannot be held responsible for any decision taken or not taken on the basis of information contained in this document, nor for the use that could be made by a third party. The investor may lose all or part of the amount of capital invested, as the funds are not capital guaranteed.

To unsubscribe or for any information request, you can email us at monocle@monocle.lu